2016 in Review: “One of the Craziest Years Ever”

Michael Ferreira recaps 2016’s multi-family market & reminds us #itsaboutsupplytoostupid.

Another year down and another insightful market overview from a go-to authority on Metro Vancouver real estate market analysis, Michael Ferreira of Urban Analytics. UDI hosted over 700 guests on October 20, 2016 to hear Ferreira’s much-anticipated summary on the year past and the drivers that have created the current environment.

OUTER SUBURBS (Fraser Valley)

Ferreira’s multi-family market overview begins in the outer suburbs. “We saw a lot of people moving from inner submarkets to the Fraser Valley” this past year, specifically noting the incredible success of an Infinity Properties townhome development in North Langley. The development, Woodland Park, was marketed by Frontline’s very own project marketing team and sold nearly 90 units in the first weekend. Townhome product supply dropped 80% over 2016 and prices increased 30-50%. “They leveled out a bit after the foreign buyer tax,” Ferreira explains, noting that this is primarily an end user market.

We also saw lineups for low-rise apartment product for Yorkson Creek, a project in North Langley targeting the move-down demographic. “Clearly there is a demand for downsizer product in this market.”

INNER SUBURBS (Ladner, Richmond, Burnaby, Tri-cities)

There were more line-ups in the inner suburbs as well, absorbing all but 9 of the nearly 800 new townhomes launched in 2016. Trillium managed to sell out their site in Port Moody in just one week and Saville Row in Burnaby sold all but 5 of their 161 units over the course of this year. “What’s amazing is the price change over the past year,” says Ferreira. Saville Row launched townhomes at $480 per square foot a year ago and in the launch of their last phase, just a couple months ago, are selling through at $835 per square foot. Supply of townhomes in the inner suburbs dropped 65% year over year and prices climbed 15-40%.

High-rise condos did phenomenally well in 2016, selling over 5,700 units. There were line-ups just for the previews at Lougheed Town Centre. “It finally seems like the imminent completion of the Evergreen Line is starting to generate a lot of demand” in Burquitlam, explains Ferreira. 99% of the units released this year have been sold. A number of projects built off the momentum of Shape Properties Brentwood Town Centre, with Concord Pacific selling over 700 units this summer at upwards of $800 per square foot. The high-rise market in Metrotown saw very little action until just a few weeks ago when Anthem Properties and Beedie Living launched 344 units at Station Square and sold all but 8 homes. The 5th tower launched on October 16, 2016 with another 300 deals written.

VANCOUVER

There were only 56 new townhomes released this year in Vancouver with all but 3 sold. “This is where I get frustrated when people say supply isn’t an issue,” says Ferreira. We saw an 84% drop in supply with only 230 units sold in 2016 so far.

Low-rise wood frame product sold through 500 units in 2016 with supply down 89%. Despite the massive drop in supply, prices only increased 10-25%. Ferreira explained that this is primarily due to the bulk of Vancouver’s wood frame product being in East Vancouver, a generally less desirable location.

Vancouver’s high-rise segment moved 2,500 units in 2016 and despite, among other things, the foreign buyer tax, the demand is still there. All but 60 of the 876 new units launched downtown have sold. Bosa proved this with a very successful launch of Cardero, selling 111 of 119 homes since August 20th.

SO, WHAT’S DRIVING ALL OF THIS?

On the Demand Side

Ferreira explains that the weak Canadian dollar and low interest rates continue to contribute to the demand equation but with 30,000 – 40,000 new immigrants coming to BC each year, demand is largely a function of immigration. A good portion of that immigration is from China’s upper class. “I don’t think we really realize just how much money is coming from that part of the world,” explained Ferreira. The stimulus growth in China over the past 5 years has been astonishing, generating an unprecedented amount of both debt and profit. Those on the profit side are looking all over the wold for places to invest it or park it, and they like Vancouver. “We need to get used to more of that capital ending up here.” We are also seeing growth in interprovincial migration with many migrants continuing to come from Alberta as the province is currently struggling.

On the Supply Side

This time last year Ferreira was telling us how sales activity was way up and inventory was WAY down for all product types across Metro Vancouver. In the 4th quarter of 2015, right after Ferreira’s last update, sales exceeded the number of available units for the first time. Not surprisingly, this was followed by rapid price escalation.

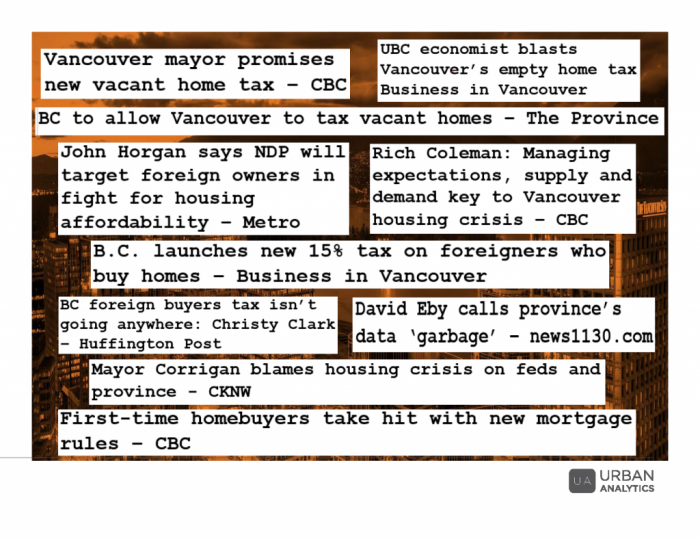

So, what does the government do to address the price escalation? Attack demand. “Let’s be honest. It’s a Chinese buyer tax. The rest are collateral damage.” Ferreira goes on to explain that the tax has had a minimal impact. While sales are down slightly there are certain parts of the market that are still quite strong, primarily in the more affordable product segments. There’s “a bit of a stand-off between buyers and sellers right now” and without an increase in supply we aren’t going to see prices fall very quickly.

The Federal government has also gotten involved by introducing new mortgage rules. “Let’s screw the buyers who’ve affected affordability the least but are most impacted by it.” Ferreira believes this policy is going to have a meaningful impact on the market, especially for the entry level buyer and move-up buyer, and anticipates it will take about a year for the market to absorb the change.

“I have another idea. How about adding some more supply!?” Ferreira admits it’s not going to fix the entire problem but it’s obvious we need more of it, pointing out that we currently only have 1.4 months of supply on the market.

Ferreira had another idea, “how about we start saying yes more often?” Yes to more density in our own neighbourhoods, yes to more transit, yes to a wider range of product types and price ranges, yes to thoughtfully building more great neighbourhoods in Vancouver, yes to hiring more staff at the municipalities to speed up approvals and yes to development. “Just say yes!”