Abbotsford & Gloucester Industrial Market Update

2016 saw a substantial increase in industrial real estate activity in Abbotsford and Gloucester.

2016 saw a substantial increase in industrial real estate activity in Abbotsford and Gloucester. Strata units, industrial zoned land and freestanding building sale prices all increased across the Fraser Valley, with lease rates also increasing in early 2017. There was a good level of absorption across all industrial product types, which means the majority of properties that came to market were sold/leased. The absorption and transaction volumes in both areas demonstrate the ever-increasing demand for industrial real estate in the eastern Fraser Valley, while supply remains low. This indicates a strong seller’s market.

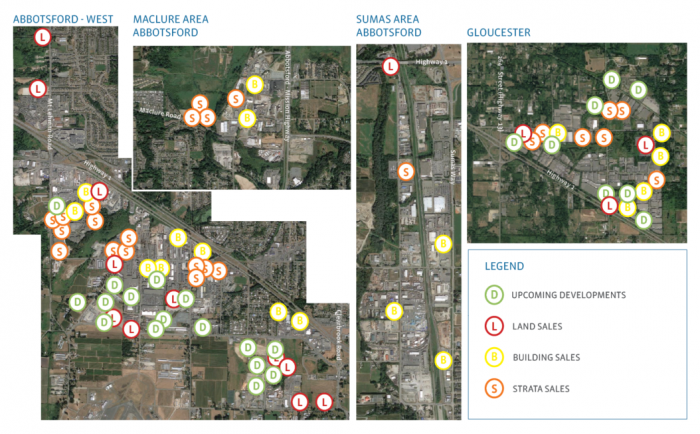

Below are 4 maps showing where the activity is taking place and what type of assets are transacting in the different submarkets. They cover Gloucester and three key industrial submarkets in Abbotsford.

The Abbotsford and Gloucester markets are similar due to their locations and access to major routes. Gloucester pricing is often used as an example of where the Abbotsford market is heading in regards to sale prices and lease rates. Both markets are experiencing high demand; however, Abbotsford still has supply while Gloucester is nearly built out. This distinction results in varying levels of market activity, which is made apparent by the below statistics:

Abbotsford Market Highlights

- Abbotsford experienced a 112% increase of dollar volume of industrial real estate transactions in 2016 compared to 2015.

- There is currently over $24,000,000 of industrial land under contract in West Abbotsford (not represented on map).

- Land: 2016 industrial land sales saw a 65% increase in dollar volume compared to 2015.

- Freestanding Buildings: The number of freestanding building sales increased by 266% in 2016 over 2015.

- Strata: There has been an increase in strata resale turn over but no new strata developments in Abbotsford West since 2004.

- Upcoming developments: Most new construction is being custom built for a specific business, not on spec.

Gloucester Market Highlights

- In 2016, over 200,000 square feet of industrial space was leased in Gloucester across two new construction multi-tenant developments.

- Land: There were limited land sales as 5 individuals hold all the remaining developable land, with 61% of it being held by 1 company.

- Freestanding Buildings: In 2015 – 2016 there were 5 freestanding building sales due to low supply and low turnover.

- Strata: A new record sale price (per square foot) for strata was set at approx. $175 per square foot in late 2016. A dramatic increase from $150-160 per square foot in late 2015/early 2016.

- Upcoming developments: The majority of new developments planned for 2017 are build to suits that will be built for (and then leased to) a specific business.

For further insight into the Fraser Valley industrial real estate market contact Frontline’s industrial sales & leasing specialists: Todd Bohn Personal Real Estate Corporation and Kyle Dodman at 604-583-2500 or [email protected].

All statistics are garnered from Commercial Edge sales data from January 2015 – December 2016 and Frontline Real Estate Services’ internal research and sales data.