Economics: A “Good News Story” for Real Estate

According to Craig Wright, SVP & Chief Economist with RBC, the economy is doing well, fundamentally speaking, and this indicates a positive future for Canada`s real estate industry.

Craig Wright talked global economic influencers, trade partners, national economic health and BC’s high-performance outlook at UDI’s April Luncheon in Vancouver on April 21.

“Most of the risks to our real estate market lie outside our borders.”

Wright started with the big picture saying that, on a global scale, it’s about market volatility, monetary policy and oil prices. The continued daily movements in commodity and equity markets make volatility a real risk. Global interest rates have never been this low for this long in the history of interest rates. The political battle between OPEC (Organization of the Petroleum Exporting Countries) and Saudi Arabia has left most nations feeling the pain when it comes to oil prices, but we should expect to see a moderate correction soon as even Saudi Arabia can’t sustain current prices.

China’s economy plays a significant role not only in the global economy but in Canada’s as one of our key trading partners. Wright maintains confidence in the Chinese economy, noting that should China’s growth falter, the country is more than well-equipped to combat it.

Narrowing the focus to our continent, Wright looked to our largest trading partner: The United States. Interestingly, as a percent of Canada’s total exports, the US only makes up 75% now, down from 85%. BC is even more diversified; the US only comprises 65% of total exports. We may see an increase in this as employment in the US is down to 5% and consumers are beginning to deleverage themselves as housing prices have recovered.

Focusing on Canada, Wright provided these Coles Notes on Canada’s economy:

- The Canadian Dollar is right where it belongs for an exporting nation, around 70 to 80 cents

- The labour market continues to improve with job growth diversified across industries

- We won’t see an increase in interest rates anytime soon

- The federal budget will act to support growth – although it’s debatable whether we need it

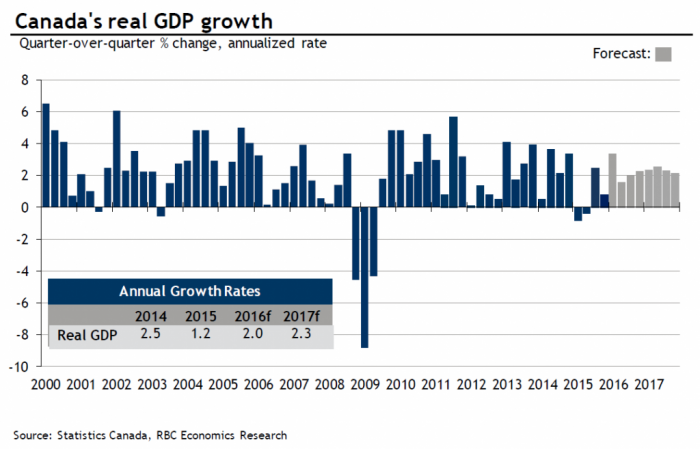

- We will see GDP growth around 1.5%, a bit above potential, but nothing exciting

Wright adamantly pointed out that the Household Debt to income ratio is the worst indicator to look at for household health. It can signal some vulnerability but doesn’t necessarily indicate that a problem is coming. Debt goes the way the housing market goes and it’s the residential market that’s driving a lot of the debt growth for households. It’s not necessarily a problem and we are in the process of stabilizing the ratio.

Bringing the conversation home to British Columbia, Wright boasted that BC continues to outperform most provinces. Wright tells it as an energy vs. non-energy story and emphasised that it is BC’s diverse economy that has it leading the pack in real GDP growth relative to energy sector-reliant provinces. Job growth in BC is very strong with increases in 75% of the 16 job sectors and a 3% year over year growth compared to the national 1% growth. Unemployment in BC has dropped below Alberta for the first time since data has been collected and is expected to stay at 6%. New jobs will be easily absorbed by the increase in demand due to migration, both interprovincial and international. Interprovincial migration has hit a 25 year high, and migration from Alberta is just starting, as Alberta nears the 2 year mark of its economic decline.

There is no such thing as a Canadian housing market.

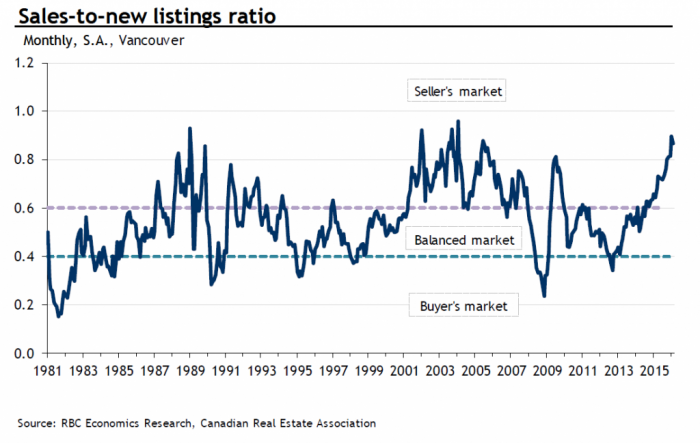

According to Wright, there are only regional markets, which are well contained and balanced. “Most indicators for the housing market are flashing green still” stated Wright, citing that resale activity is strong, new listings are up 4.5% and the country is flirting with an all-time high in sales to new listings ratio. A ratio that is looking like it’s going to keep going up. The biggest challenge is housing supply as Inventory is nearing an all-time low.

Population growth and housing value growth is driving consumer spending. Interestingly, consumers appear to be more comfortable spending real estate wealth than wealth from other asset classes, such as stocks. It’s a curious trend but one that is putting money into the economy.

Wright concluded that, economically, BC is doing very well, boasting budget surpluses and low debt. All signs point to the real estate market maintaining its current strength.