Fraser Valley Residential Real Estate: April 2021 Infographic

The Fraser Valley real estate market continued its unprecedented trajectory in April… for the most part. If you look closely, you can see what appears to be the first signs of it tapering off. It’s subtle and only emerging in the single family segment so far but that is always the segment that moves first.

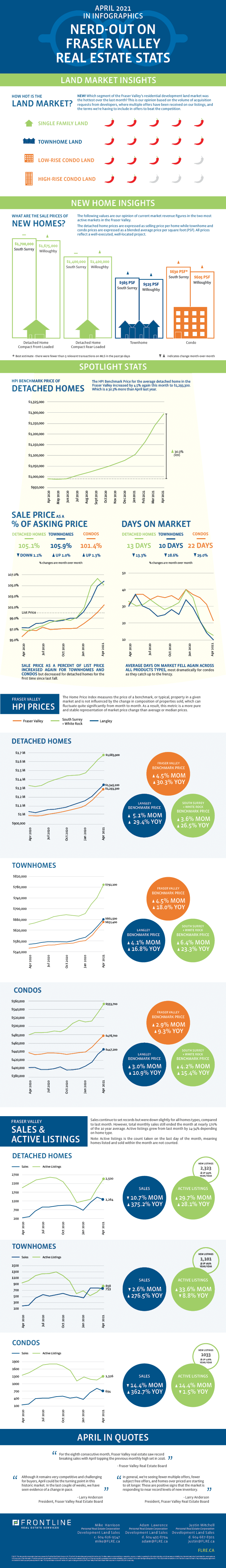

Sales set another monthly record in April even surpassing the frenzy of 2016, which set the previous all-time record for the month. Total sales ended the month at 168% of the 10 year average despite all three major housing types seeing mild declines in sales from last month.

April saw massive quantities of new listings come to market and, despite days on market continuing to plummet, active listings still increased 14-34% depending on the home type.

Benchmark prices are still rising by enormous increments for all major home types with townhomes up 4.5% over last month, condos up 2.9% and detached homes up 4.5%. With that said, this is where we are seeing one hint of the extraordinary pace easing off ever so slightly: the month-over-month increase in the detached home benchmark price is slightly less than last month.

The other early sign of the market mellowing out is sale price as a percent of list price for detached homes declined by 1.1%. On average detached homes are still selling for 105.1% of the list price but it’s the change in directionality that’s worth paying attention to. Sale price as a percent of list price is still rising rapidly for townhomes (up 1.0%) and condos (up 1.3%) but these segments typically lag behind single family by a few months.

What does this mean for development land in the Fraser Valley?

It remains to be an incredibly tight market for residential development land in the Fraser Valley caused in part by developers’ apprehension to sell sites out of fear of being unable to replace it and “mom and pop” land owners exercising patience, betting on land values continuing to climb. Buyer demand for condo land has caught up to townhome and single family land now that we have seen a couple months of significant end product price increases and incredible absorption at new projects.

Logic would dictate that if home prices are climbing, higher prices can be paid for land but any increase in land values is being tempered by outrageous increases in construction costs. Lumber is stealing the spotlight in the media but we’re hearing it’s across all materials as well as labour costs. This is compounding the land supply challenge noted above in that many land owners equate rising home prices with equivalent increases in their land’s value. The reality is the increase in construction costs is wiping out a good portion of the value we would have expected to go to the residual land value. The result is a growing divide between seller’s price expectations and what can realistically be paid for the land.

Check out our curated summary of the Fraser Valley Real Estate Board’s April stats in infographics below.

View the Fraser Valley Real Estate Board’s entire stats package for April 2021 here.

This representation is based in whole or in part on data generated by the Fraser Valley Real Estate Board which assumes no responsibility for its accuracy.