Fraser Valley Residential Real Estate: February 2021 Infographic

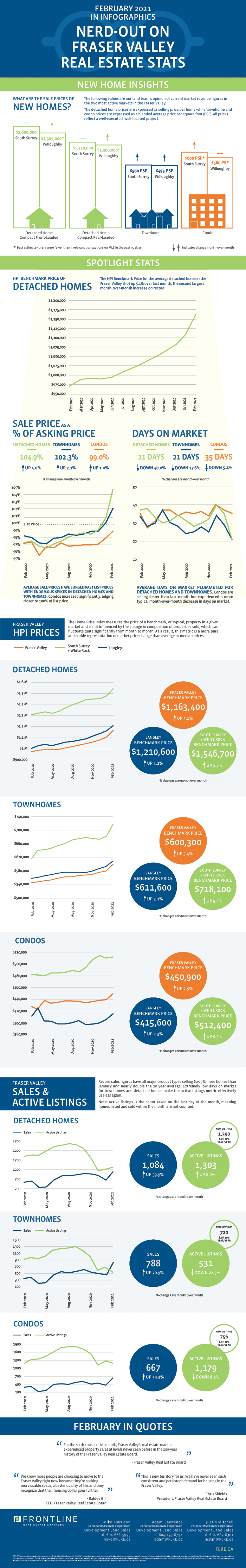

I’m running out of ways to say the Fraser Valley residential real estate market is on fire and it’s only February, a month that is typically still waking up from the winter frost. The Fraser Valley Real Estate Board’s statistics are reporting a 6th straight month of record sales and unprecedented velocity. Benchmark prices are moving in leaps and bounds each month, days on market have hit the floor, and sale prices are being achieved way over original list prices.

Sales in February were 60-79% higher than last month, depending on house type, and 93% higher than the 10 year average for the month. Active listings are down – but don’t forget that this metric represents the count of active listings on the last day of the month, not a cumulative figure. So, when a listing sells in 2 days, it doesn’t get counted. Despite this metric’s shortcomings, active listings are clearly not keeping up with demand when days on market are plummeting (detached homes selling almost twice as fast as last month) and sale prices are 105% of original list price for detached homes and 102% for townhomes. The condo market is no slouch either at 99%. At this rate of increase, condos will surpass 100% in March.

The HPI Benchmark Price of the average detached home in the Fraser Valley shot up 5.1% from last month. Only one other month in Board history has seen a month-over-month increase greater than this and it occurred in May 2016. Historically, the market peaks in May but we’ve reached that market velocity in February! Until recently, condos were tracking to more seasonal norms but even that segment has begun to take off with a 2.5% increase in the Benchmark price over last month.

What does this mean for development land in the Fraser Valley?

Values are spiking for all land types in nearly all locations. It’s no longer just readily developable single family or townhouse land it’s now condo sites, long-term development land with no NCP, everything. Similarly, deal terms continue to compress, squeezing out buyers less familiar with a neighbourhood as their local competition makes an aggressive move on the same site.

While a portion of the activity may be driven by a fear of missing the runaway train, the massive confidence among developers and investors is being supported by phenomenal absorption at new projects despite sale prices increasing every weekend.

I’ve been saying for a few months that it’s only a matter of time until townhouse prices reach a point where consumers are forced to purchase condos instead. We have just seen the first signs of this with reports of huge sales at new condo projects. Anecdotally, the last month saw a noticeable increase in the volume of requests we received for wood frame condo sites.

Check out our curated summary of the Fraser Valley Real Estate Board’s February stats in infographics below.

View the Fraser Valley Real Estate Board’s entire stats package for February 2021 here.

This representation is based in whole or in part on data generated by the Fraser Valley Real Estate Board which assumes no responsibility for its accuracy.