Fraser Valley Residential Real Estate: October 2021 Infographic

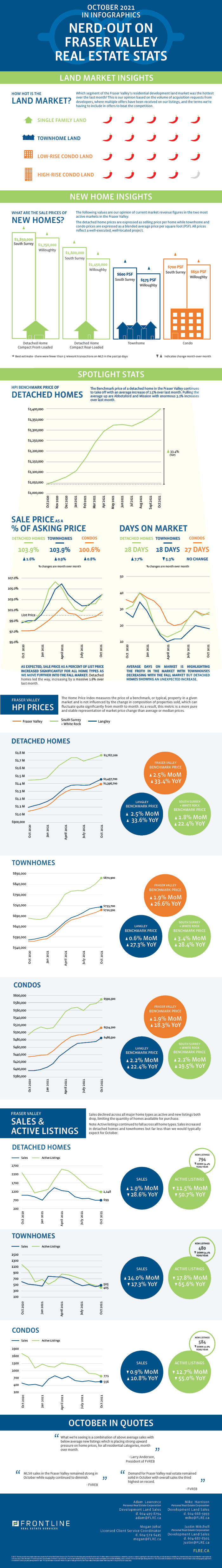

“Frothy” is the word that comes to mind as we dig into the October statistics from the Fraser Valley Real Estate Board. A sustained low quantity of new and active listings coupled with insatiable demand produced another month of enormous increases in Benchmark prices.

New listings were down 23% to 34% over last year and came up short, once again, compared to the 10 year average. As a result, active listings fell across all major home types, failing to reach even 50% of what was on the market this time last year. Total active listings ended the month at only 45% of the 10 year average for the month of October.

The rampant demand and competitive market are highlighted by massive increases in sale price as a percent of original list price across all home types. Townhome and detached homes are, on average, selling for nearly 104% of the original list price. Average days on market continued to fall for townhomes but curiously, it rose slightly for detached homes, so we’ll be watching that closely to see if it’s an anomaly or the beginning of a shift as market trends in the Fraser Valley are often led by the detached home market.

As mentioned, Benchmark prices continued their near-vertical trajectory with detached homes seeing a 2.5% month-over-month increase, with townhomes and condos both increasing by 1.9%. Pulling the average prices up are a few outperforming segments, such as:

- Detached homes in Abbotsford and Mission with a 3.1% increase (MoM)

- Townhomes in South Surrey showing a 3.4% increase (MoM), and

- Condos in North Delta posting a 3.1% increase (MoM)

What does this mean for the development land market in the Fraser Valley?

The land market in the Fraser Valley is similarly frothy and moving at such a frenetic pace that it’s difficult to differentiate real transaction data from conversational price expectations and hearsay. With that said, more often than not, the seemingly outrageous land values can be supported if you have the latest end product revenue data.

Market sentiment remains incredibly bullish and the continually shrinking supply of available development land has prices climbing, at what feels like a weekly rate. As expected, deal terms are compressed but appear to have bottomed out in most cases, reaching their lower limit.

Check out our curated summary of the Fraser Valley Real Estate Board’s October stats in infographics below.

View the Fraser Valley Real Estate Board’s entire stats package for October 2021 here.

This representation is based in whole or in part on data generated by the Fraser Valley Real Estate Board which assumes no responsibility for its accuracy.