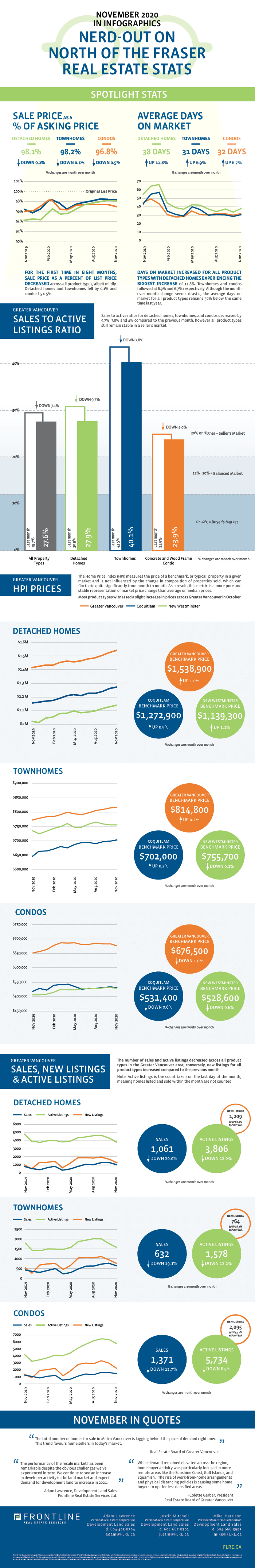

North of the Fraser Residential Real Estate: November 2020 Infographic

November was another strong month for the Greater Vancouver resale housing market with the number of transactions topping 3,000 for the first time since 2015, making November 2020 the second busiest November on record. The 3,064 single family, condo and townhome sales were a 22.7% increase over the same period last year and a whopping 24.6% above the 10 year November sales average.

While sales volumes were up for all product types compared to a typical November, the benchmark price for condos actually decreased by 1% compared to last month. This is surprising considering the number of condos that sold relative to available inventory but does reflect the broader market sentiment that sales are being driven by owner-occupiers looking to move up to either a single family home or a townhouse. November benchmark prices for single family and townhomes back this sentiment, with increases of 1% and 0.2%. over October.

The Board also notes that sales in more remote areas like the Sunshine Coast, Gulf Islands and Squamish were particularly strong last month. This increase in demand has been attributed to the rise of work from home arrangements, which are eliminating the need for some workers to be based in close proximity to Vancouver proper. Whether this becomes a long-term trend or simply a short-term product of the ongoing pandemic remains to be seen.

So What Does This Mean For The Development Land Market North Of The Fraser?

Record-low interest rates combined with buyer preference for larger homes has created some interesting dynamics in the Vancouver land market in 2020. Single family and slab on grade townhouse sites are still in the highest demand, however opportunities for these types of development sites are sparse North of the Fraser, especially those providing large scale development with a quick timeline. Buyers can expect multiple offers, higher prices, and compressed deal timelines when pursuing these types of opportunities in the short to medium term.

After many months with little to no action, we are starting to see a pulse in the higher density land market with subject removals moving forward and sites going under contract. That being said, bid prices for these opportunities are down drastically, in some cases as much as 50%, from the peak of the market. Vendors of higher density sites will need to be prepared to allow considerable due diligence time when negotiating with a buyer. Considering the lack of speculators and investors operating in the pre-sale condo market, we expect this dynamic to continue into 2021 with a potential continued softening of high density land prices. There is hope on the horizon however, as Canada and Greater Vancouver in particular are expected to see record levels of immigration over the next several years, once people are able to move around the world again. This should provide a much needed increase in demand for higher density multi-family units.

Please note: areas covered by the Real Estate Board of Greater Vancouver include: Whistler, Sunshine Coast, Squamish, West Vancouver, North Vancouver, Vancouver, Burnaby, New Westminster, Richmond, Port Moody, Port Coquitlam, Coquitlam, Pitt Meadows, Maple Ridge, and South Delta.

View the Real Estate Board of Greater Vancouver’s entire stats package for November 2020 here.

This representation is based in whole or in part on data generated by the Real Estate Board of Greater Vancouver which assumes no responsibility for its accuracy.