Selling Development Land? 3 Correlations Between the Land Market and Housing Market

Selling development land and selling a house may be very different when it comes to the sales and marketing process, but the two markets are quite closely connected. The current level of activity, sale prices, and the general sentiment of the housing market are primary drivers of the residential development land market. Therefore, understanding the link between them is essential when selling your development property. Let’s look at the three leading ways the housing market influences the development land market.

TOP 3 WAYS THE HOUSING MARKET INFLUENCES THE DEVELOPMENT LAND MARKET

1) The Housing Market Impacts the Demand for Land

When houses sell quickly this drives more demand for land. When houses are selling quickly builders will be more actively looking for land to buy to build new homes on. In this case, the demand, and thus the competition, becomes higher for land. If the demand is high, available land may sell more quickly over time and with more favourable pricing and terms for the seller.

2) The Housing Market Impacts the Type of Land in High Demand

The types of homes that are selling well will drive demand for that type of land. Builders will typically prefer to build whatever types of homes are in high demand.

For example: if sales of large, detached homes are not performing very well, builders may not be interested in purchasing land that is designated for the development of this product type. On the other hand, if townhome sales are strong, then builders will be more motivated to buy land that is designated for a townhome development.

3) The Housing Market Impacts the Value of Land

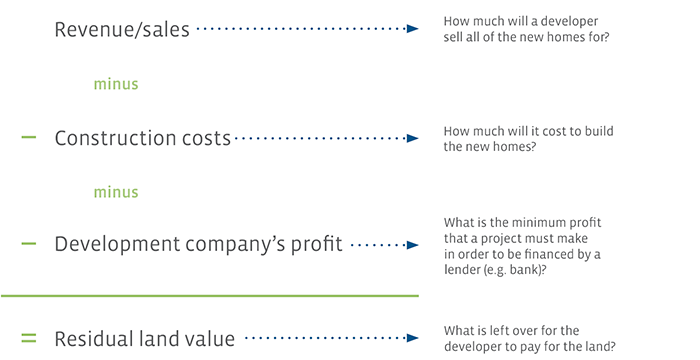

Developers and builders will calculate the residual land value to evaluate the value of a development site. Simplified, this method works backwards from the sale price of the homes they could build on a property and subtracts the construction costs and the required profit*. The residual land value is simply the amount that is leftover that the developer or the builder can pay for the land. Click here to learn more about calculating development land value.

* A note on builder/developer profits: The profit is calculated as a % of all costs associated with the project. A lender won’t provide financing if the profit is too low, which means the builder is unable to purchase the land.

AN EXAMPLE OF HOW THE HOUSING MARKET IMPACTS THE VALUE OF LAND

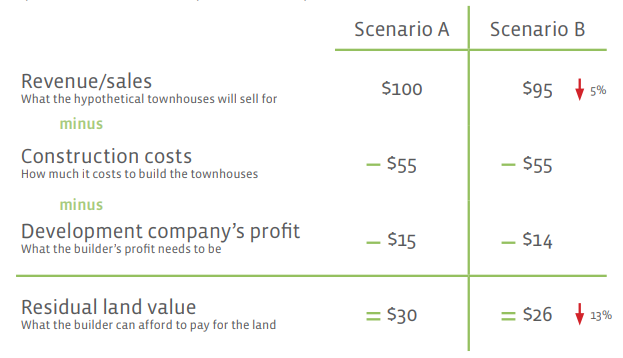

To illustrate how a change in the sale prices of new homes influences land value, let’s look at a hypothetical townhouse example. Note: The values below are deliberately simplified values; these values only represent the connection between the factors used in the calculation below.

As outlined in the residual land value explanation above, there are four factors considered in these two scenarios: the revenue (or sales), cost of construction, profit of the builder/development company, and finally, the residual land value.

Let’s see how the selling prices of new homes can influence land value:

In scenario A, the sales price of the homes is $100, the cost of construction for the new homes is $55, and the profit of the developer/builder is $15. This calculation results in a residual land value of $30.

In scenario B, the sale price of the homes is $95, the cost of construction for the new homes is $55, and the profit of the developer/builder is $14. Now, the residual land value is only $26. A 13% decrease from the land value in scenario A.

As you can see in scenario B, the sale price of the home fell by only 5%, which caused the residual land value to drop by 13%, even with a lower profit. This illustrates how a decline in home prices can cause a decrease in the price a builder/developer can pay for development land. However, this also works in the opposite direction – when home prices increase, builders can often justify paying more for the land.

How to APPLY WHAT YOU JUSt LEARNED

As you have learned, development land values are closely tied to the prices of homes as well as the level of demand in the market. So, it is always worth paying attention to the market as a whole. Below are some examples of how you can apply your new market knowledge, whether you are considering selling your development land property now or not.

I Plan to Sell My Development Property Soon

If you are thinking of selling your property in the near future, then you can apply this knowledge to:

- Guide list price strategies and sale price expectations

- Build your understanding of the risks development land buyers take on and how those risks affect the buying behaviour of builders and developers

- Help you evaluate if a potential buyer’s concerns are valid or not

- Explain changes in your property’s value

- Assist you in choosing a Realtor – a Realtor who specializes in development land sales will understand these concepts

I Am Not Planning on Selling My Development Property Anytime Soon

If you aren’t planning to sell your property anytime soon, then you can apply this knowledge to:

- Understand what future market conditions could help you sell your property for a higher price (eg. waiting for home prices to go up)

- Indicate how fast growth and development may occur in your neighbourhood

- Confirm that not selling your property at this time is the best strategy for you

If you have any questions about the information above, please do not hesitate to contact us.