“Signs of a Tight Spring Market” from Ramlo

Key take-aways from Andrew Ramlo’s stats-focused UDI presentation on April 20th, 2017.

Andy Ramlo is the man behind Bob Rennie’s numbers and has a uniquely entertaining approach to the nerdy side of the real estate market. Ramlo, the Vice-President of Market Intelligence of the Rennie Group and Executive Director of the Urban Futures Institute, presented to a full house at a UDI luncheon in Vancouver on April 20th. Here are the key take-aways from his presentation:

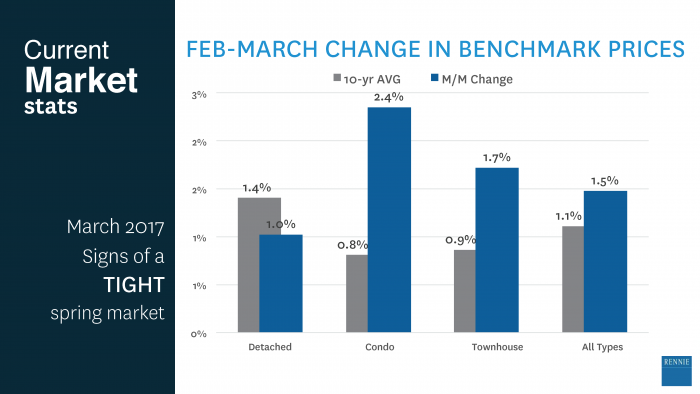

Signs point towards a tight spring market with continued upward pressure on prices. Month over Month, sales in March were up 52% across all product types with listings up a mere 3%. Benchmark prices are up across all product categories and were above the 10 year month over month average price increase for March.

Average sale prices look very different when you ignore the top quintile. For Ramlo, perspective is key in a lot of the statistics we see. For example, in 2016 the average sale price of an attached home in the Lower Mainland was $610,602. The average of the top 20% of sales was nearly $1,200,000. If you remove this top quintile, the average price of the remaining 80% is $468,672.

Foreign buyers’ share of sales has dropped. Rennie tracks foreign buyers of the product they market and in July of 2016 foreign buyers made up just over 15% of purchasers. It dropped to 0.9% in August when the foreign buyer’s tax was introduced and appears to have stabilized around 4% in the months since then. Rennie reports the Fraser Valley experienced far less of a decrease in foreign buyers after the tax was introduced in August, moving from 3.3% foreign buyers in July 2016, down to 1.6% in August and stabilizing just over 2% by February 2017.

In Vancouver, there is a massive $221 billion in mortgage free equity amongst those 55 years of age and older. This equity is being transferred to the younger generation to help them buy their first home (42% of first time buyers had help from parents). Ramlo’s case study illustrated that the price a buyer can pay increases by 30% when parents help their kids reach 20% down. This skews the sale price to income ratio which Ramlo was clear is a “fundamentally stupid metric” anyway.

BC’s population will continue to grow and the demographic composition will change significantly. The number of seniors will nearly double by 2036 and it’s not until they reach 85 that the household maintainer rate begins to decrease. The longer seniors loiter in their homes the longer our challenges will remain. You may think housing gets freed up as the aging population pass on, and you would be right, but the housing needs of the younger generation as they enter and move up in the market, is 3 times what is currently being freed up.

Supply is forecasted in excess of demand in the coming years. CMHC’s reported housing starts are at an all time high. Some of those starts will go to replacement demand as old homes are knocked down, but that should only account for 2-5%. This is good news.

But… the new product coming to market is already sold. Urban Analytics reports 16,500 new units coming to market in 2017 and almost 50,000 by 2022. Unfortunately, 97% percent of the 2017 inventory is already pre-sold. Even 91% of new product scheduled for 2019 is already sold.

Ramlo’s stats-focused presentation cemented what many have been feeling in the last month; we are in for another very active Spring.

The charts and data behind Ramlo’s presentation can be seen in his presentation deck available here.