Willoughby State of the Market Report 2020

Below you will find this year’s State of the Market report on residential development in Willoughby. Included in the report, you will find an analysis of 2019 land sales activity and a summary of the current development applications in the area. There is also an update on the development status of each neighbourhood in Willoughby, which we monitor closely as it’s the neighbourhood’s “timeline to development” that is a primary driver of land prices in that area.

StaTe of the Development Land Market in Willoughby

2019 was a year of recalibration for the development land market in Willoughby. Construction of recently approved development projects created the appearance of steady activity in the area but digging one level deeper, to the development land market, you can see the impacts of the broader market correction and the fallout from an enormous increase in municipal development fees from the Township of Langley (TOL).

Market Correction

There is a long list of factors behind the market correction but among them are:

- political uncertainty in some municipalities

- the mortgage stress test

- taxes (foreign buyers tax, vacant home tax, etc.)

- the self-fulfilling prophecy created by speculation that the market would decline

Due to these factors, home prices declined by 8-15% and when homes are not selling, or when home prices are in decline, home builders are not interested in purchasing land.

Development Cost Increases in The Township of Langley

Adding to the impacts of the downturn in the market, the TOL instituted a new community amenity contribution (CAC) and proposed increased development cost charges (DCC). The new CAC and increase in DCCs can be as much as $600,000 to $1,000,000 per acre in additional costs for builders. These new costs are subtracted from what a builder can afford to pay for land and the result has been an enormous price gap between what land owners thought their properties were worth and what a builder can now afford to pay.

The Result

The market downturn, concern that the market could decline further, and the spike in municipal development fees resulted in a 64% decrease in the total dollar volume of development land sales in Willoughby.

With that said, towards the end of 2019 market sentiment began to shift and became extremely positive. This had most developers and investors back in the market for their next development site. The renewed confidence in the market was pointing towards a strong 2020 until COVID-19 threw a wrench into the gears. An overwhelming majority of developers and investors we have spoken with over the last few weeks maintain confidence in the market 12-18 months out from now. We are in uncharted waters and that has some developers and investors looking to extend transaction timelines to compensate for delays in due diligence work and the general uncertainty in the short-term market.

DEVELOPMENT APPLICATIONS

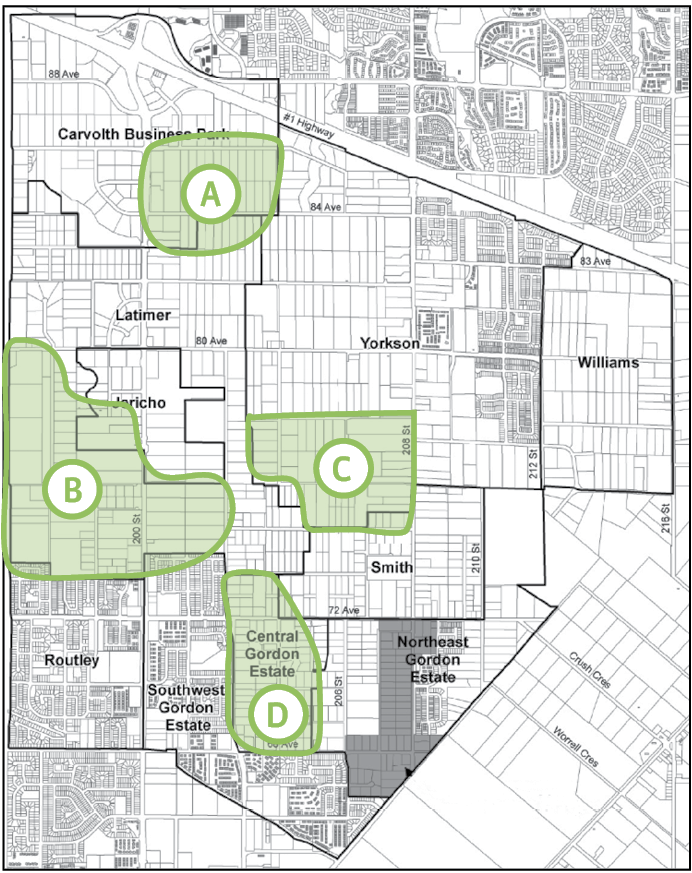

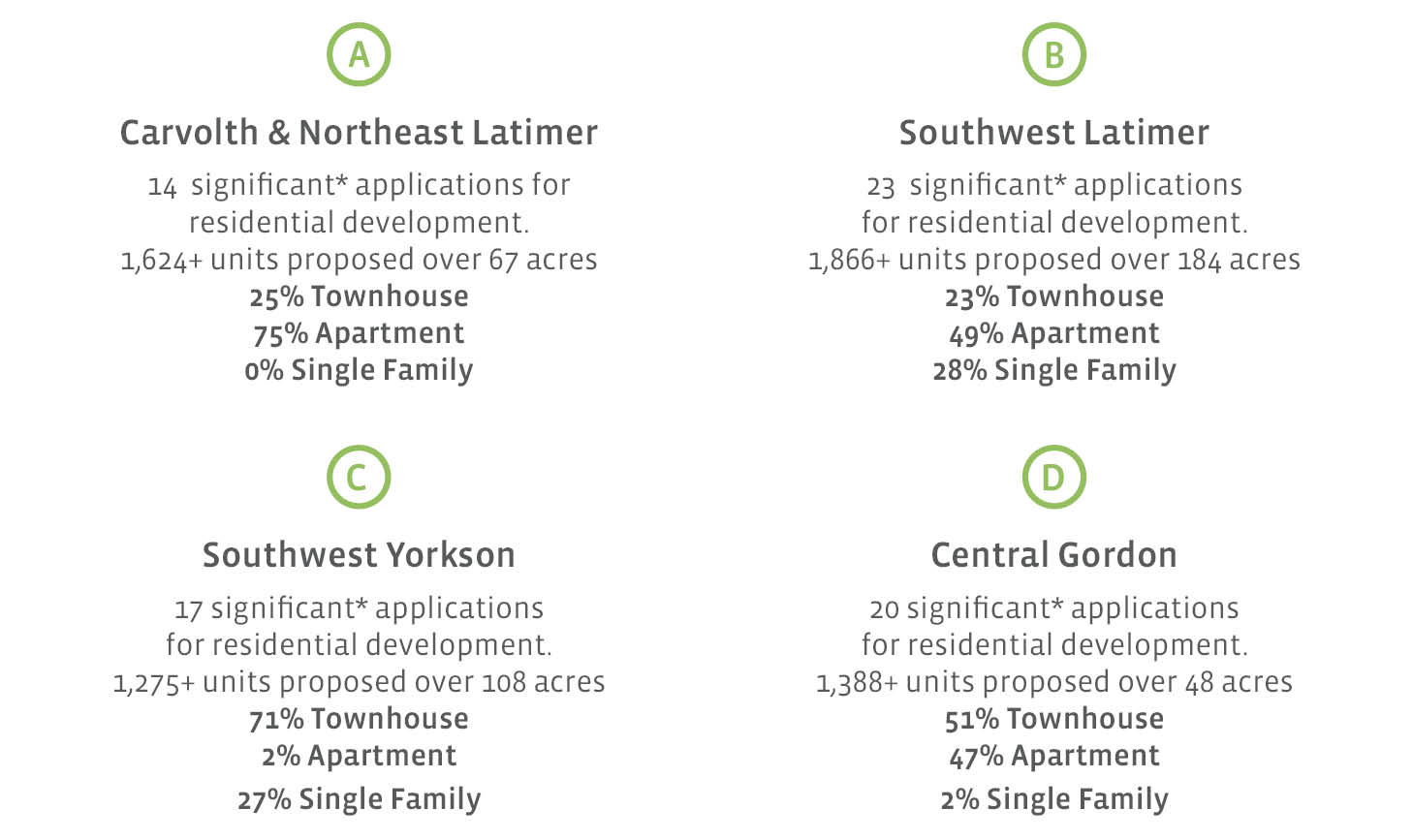

We saw an enormous number of new development applications submitted in 2019, throughout Willoughby. The green highlighted regions on the below map indicate areas containing particularly high concentrations of instream development applications and are where we expect to see the next influx of new construction over the next couple years. The summary statistics (below the map) may appear to be a lot of new inventory for the market, but these applications exist at a wide variety of stages in the planning process and will not all come to market at the same time. Of these applications a handful may come to market this year but many could take a year or two or more.

CURRENT STATE OF EACH NEIGHBOURHOOD

Carvolth

Development is roaring along in the central and eastern portions of Carvolth. The TOL anticipates the neighbourhood to be a centre of growth as 90% of the neighbourhood is under application or already built-out. 2019 saw sales launch for multiple new residential projects, leasing launch for a new office project, conditional approval of a large-scale rental apartment project, and planning progress on a handful of other applications.

Yorkson

Development activity in 2019 was primarily the continued build-out of condo and townhome projects near Willoughby Town Centre. The southwest quadrant saw the development and servicing of a large-scale mixed residential development. As much of Yorkson is already developed, land transactions were minimal and contained to the undeveloped southwest quadrant.

Central Gordon

Last year we commented on the large quantity of development applications that are stuck waiting for the construction of the stormwater detention pond on 202B Street around 71 Avenue. 4 more applications submitted in 2019 have joined this queue. This pond services most of the western portion and hope remains that it will be complete in the estimated 6-month timeline.

Smith

Unfortunately, the development status of Smith has not changed since our last report. The neighbourhood continues to be stalled, waiting for the prerequisite elementary school and park site to be secured. As a result, there was very little activity in Smith in 2019.

Williams

The TOL is looking to Williams as an exciting growth area over the coming 12-24 months. Development is critical for the success of the new 216 Street Interchange so we’re expecting to see a considerable amount of progress on approvals of existing development applications, resulting in increased development and land sale activity in 2021.

Latimer

Vesta’s Latimer Heights master planned community is well underway with continued presale success. This project will underpin subsequent developments in the northeast quadrant. The southwest quadrant is not far behind. A 30 acre development application in the southeast quadrant nearly achieved conditional approval in 2019 but it was met with an unexpected servicing challenge, as many complex developments are. As a result, development continues to be on hold there as it relies on the infrastructure services brought by this large development.

North East Gordon

It’s status quo in North East Gordon with the west side seeing a couple new single family developments and the portion between 207 and 208 Street still waiting for the required stormwater detention pond. The fractured ownership in this area is making it difficult for a developer to assemble enough land to justify building the pond and this uncertain development timeline is holding land values down.

Jericho

As we speculated in last year’s report, we have not seen any visible progress on the high-rise application that received conditional approval in 2018. Activity was limited to a few land transactions on the southwest corner of 200 Street and 80th Avenue and the future of the special study area adjacent to the Langley Events Centre remains unclear.

Southwest Gordon & Routley

These neighbourhoods are substantially built out with minimal new development.

SOURCES

In creating this report, we consult Township of Langley planning staff, survey multiple land transaction reporting systems (Commercial Edge, MLS) and analyze municipal development data to bring you the most relevant information. If you have any questions about this report or Langley’s development land market, don’t hesitate to reach out.

To receive future reports directly to your inbox, please sign up for our development land newsletter here.