Real Estate Market Forces: Industrial vs. Residential

A common misconception that we have been hearing a lot recently is that the Fraser Valley industrial market must be “cooling off”, but the actual state of the industrial market can be shocking, especially for new buyers or businesses. We hope the below information can help avoid this confusion.

WHY THE CONFUSION?

The misconception that the industrial real estate market must be “cooling off” is directly related to the recent media reports that the residential real estate market in Metro Vancouver has slowed. These reports are only about the residential market though, it is rare that industrial real estate gets any publicity outside of specialty publications. For this reason, it is understandable why many people lump all the real estate markets together.

DIFFERENT MARKETS = DIFFERENT MARKET FORCES

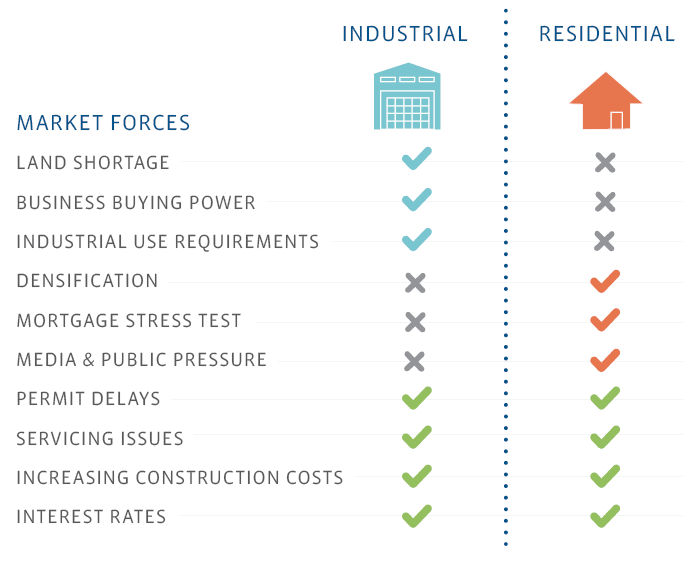

The industrial real estate market and the residential real estate market may both be driven by the basic rules of supply and demand, but there are many market forces that only impact one market or the other. Below we have highlighted some key market forces and whether they impact the Fraser Valley industrial market or not. We hope this sheds some light on why the Fraser Valley industrial real estate market continues to be a hot market.

Market Forces That Impact Industrial

Land Shortage

The region’s industrial land shortage has increased demand on all industrial real estate, driving up prices. Residential real estate is not currently impacted by an impending end of residential land supply.

Business Buying Power

A business usually has more leverage to secure lending for a real estate purchase than an individual would when securing a home loan.

Industrial User Requirements

Industrial real estate is often more expensive due to custom user requirements (loading, power etc.). Think of industrial real estate as more of a custom home than a condo.

Market Forces That don’t Impact Industrial

Densification

You cannot add to the supply of industrial real estate like you can in residential real estate by increasing density (ex: build condos where a single family home used to be).

Mortgage Stress Test

The mortgage stress test has impacted individuals’ buying power, pushing some potential buyers out of the market and decreasing demand.

Media and Public Pressure

Residential real estate is highlighted in the media much more often than industrial as it is relevant to a much wider audience. This results in pressure for residential real estate supply and affordability measures to be put into place.

Market Forces That Impact Industrial & residential

Permit Delays

Delays in the permitting process have slowed all types of construction, limiting supply and adding additional costs to owners.

Servicing Issues

Construction of new industrial and residential real estate is limited by a lack of servicing (water, drainage, power etc.) in some areas.

Increasing Construction Costs

The increasing costs of material and labour have increased prices in all new real estate.

Interest Rates

Relatively steady interest rates have kept borrowing power strong and high leverage financing is available, but home buyers have been impacted by the mortgage stress test whereas businesses buying industrial real estate have not.

How these market forces have impacted these markets

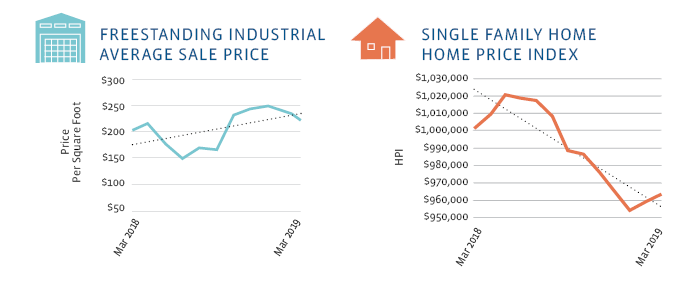

Sale Price Trends Across the Fraser Valley: Industrial vs. Residential

Industrial and residential real estate are very different, so a straight-across comparison of sale prices is not very useful. That being said, if you look at the sale price trends of the two markets it emphasizes that they experienced very different market forces, and thus sale price trends, over the last year.

From March 2018 to March 2019, the average price per square foot for an industrial freestanding building in the Fraser Valley* saw a steady price trend increase, while the Home Price Index (HPI) of a single family home saw a steady decrease.

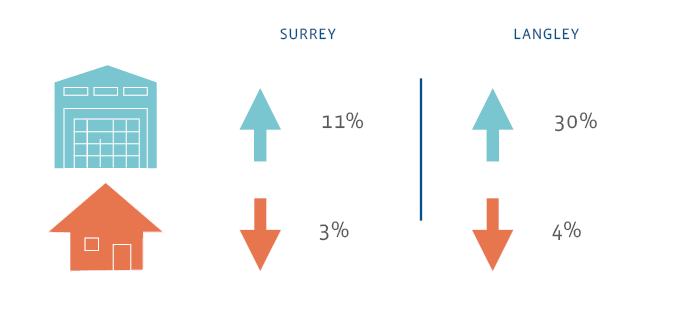

Industrial vs. Residential Year-Over-Year Price Changes in Surrey & Langley

The different trends in the two markets can also be seen when you examine the year-over-year changes in Surrey and Langley. The average sale price (per square foot) of industrial freestanding buildings has increased substantially while the HPI price of a single family home has experienced moderate decreases.

If you have any questions about these market forces and how they impact your property value or position in the industrial real estate market, feel free to reach out.

* Fraser Valley industrial sales statistics include sales in Surrey and Langley while residential sales statistics include sales from all communities covered by the Fraser Valley Real Estate Board: Abbotsford, Langley, Mission, North Delta, Surrey, and White Rock.

Sources: Commercial Edge, Fraser Valley Real Estate Board

This representation is based in whole or in part on data generated by the Fraser Valley Real Estate Board which assumes no responsibility for its accuracy.