Infographic: Greater Vancouver Residential Real Estate December 2022

The housing market in Metro Vancouver saw a significant decrease in sales and listings for December compared to last month and 2021. We are seeing a balanced market and downward pressure on home prices in the region.

KEY TAKEAWAYS FROM DECEMBER 2022 GREATER VANCOUVER RESIDENTIAL MARKET

- There was a significant decrease in the number of new listings added to the Greater Vancouver housing market, with a drop of over 50%.

- Greater Vancouver saw a decrease in home sales in December 2022 compared to the previous month and year, indicating that this is more than market seasonality as a lack of options for would-be buyers is compounding economic factors.

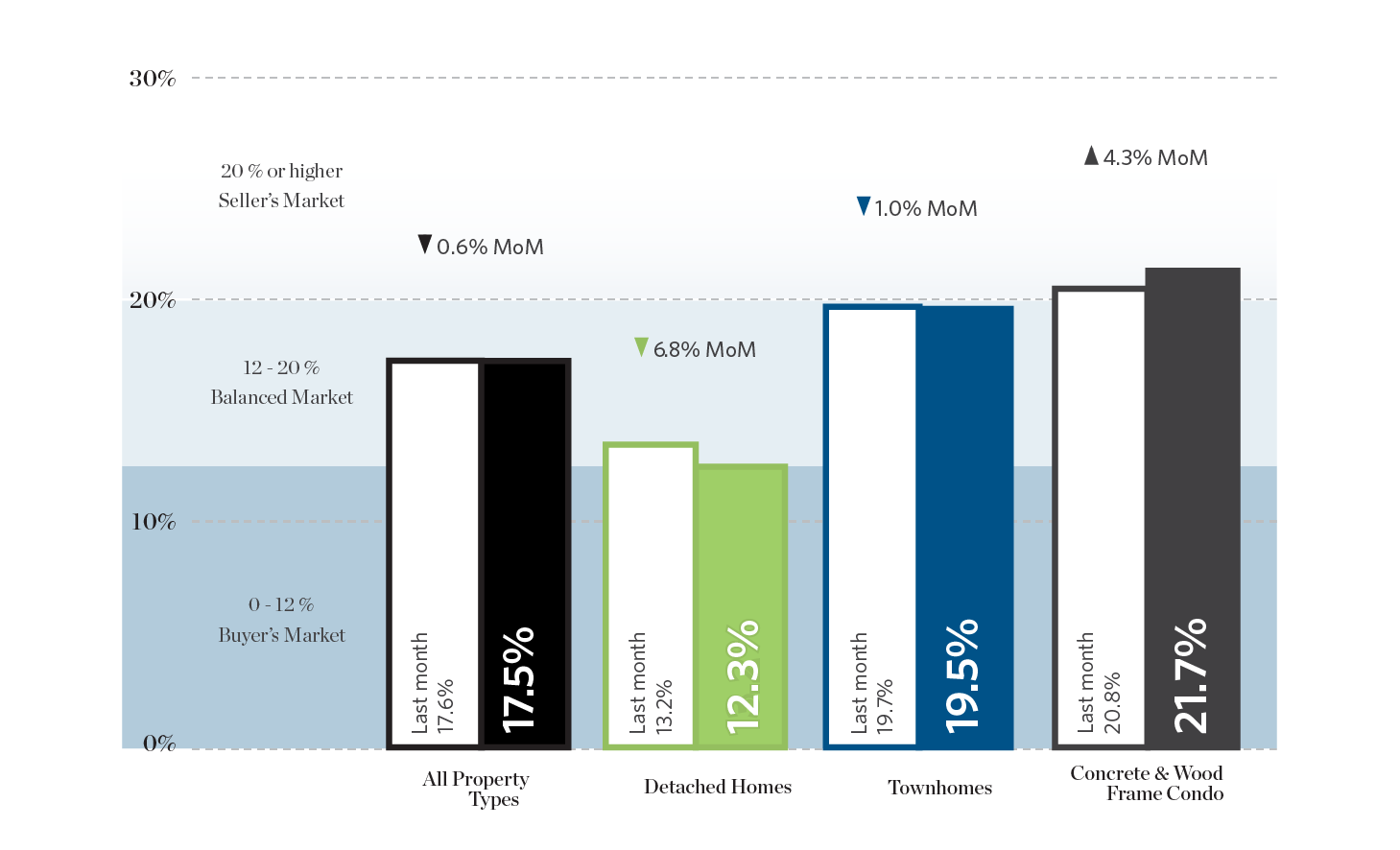

- The sales-to-active listings ratio, which is used as an indicator of the balance between supply and demand in the housing market, is below the threshold of 20% which is generally described as a balanced market and is associated with downward pressure on home prices.

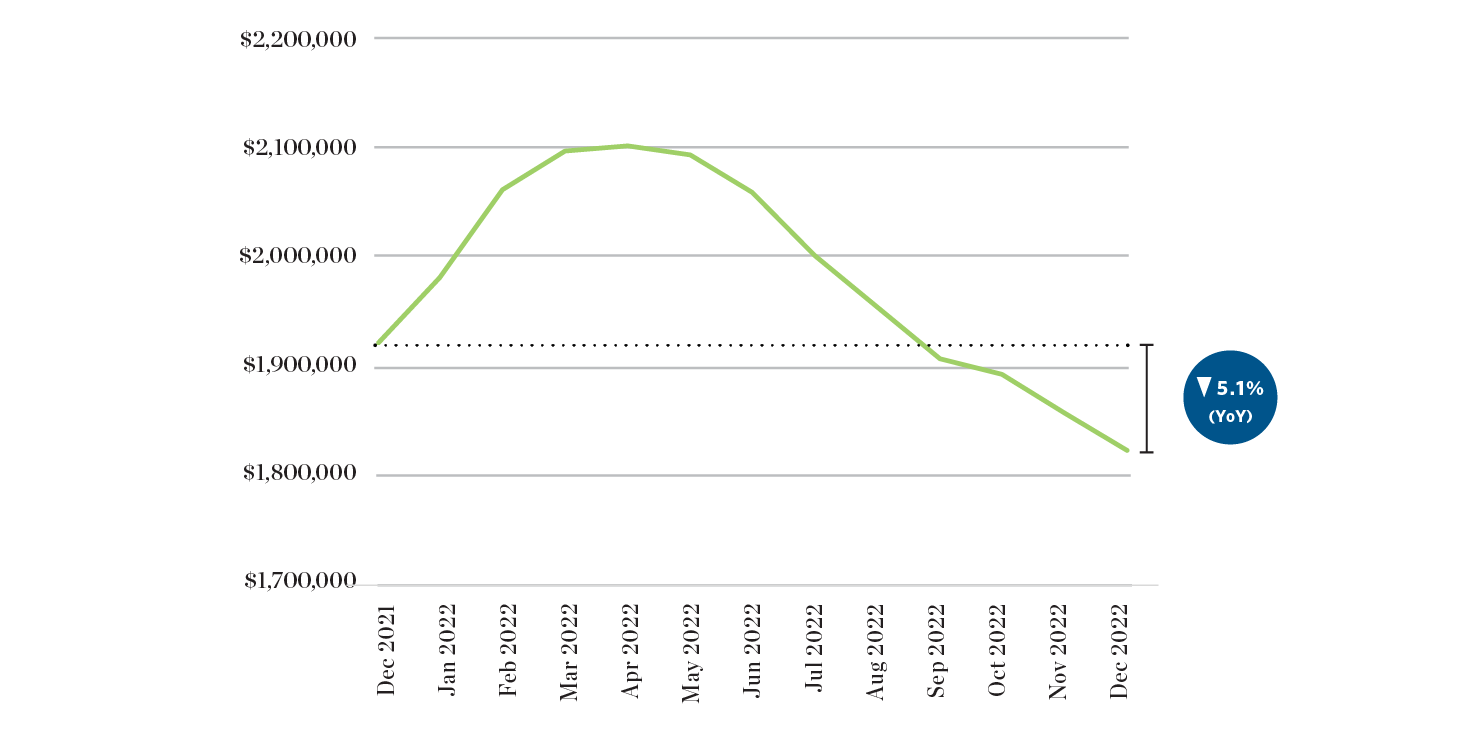

HPI Benchmark Price of Detached Homes

Benchmark prices for detached homes continues its downward trend following last month and ending the year 5.1% below pricing in December 2021.

Sale Price As a Percent of Original List Price

The average sale price as a percent of original list price continues to stabilize with minimal changes following last month’s trend. It remains between 90 and 100% for all product types, indicating buyer and vendor expectations are slightly misaligned.

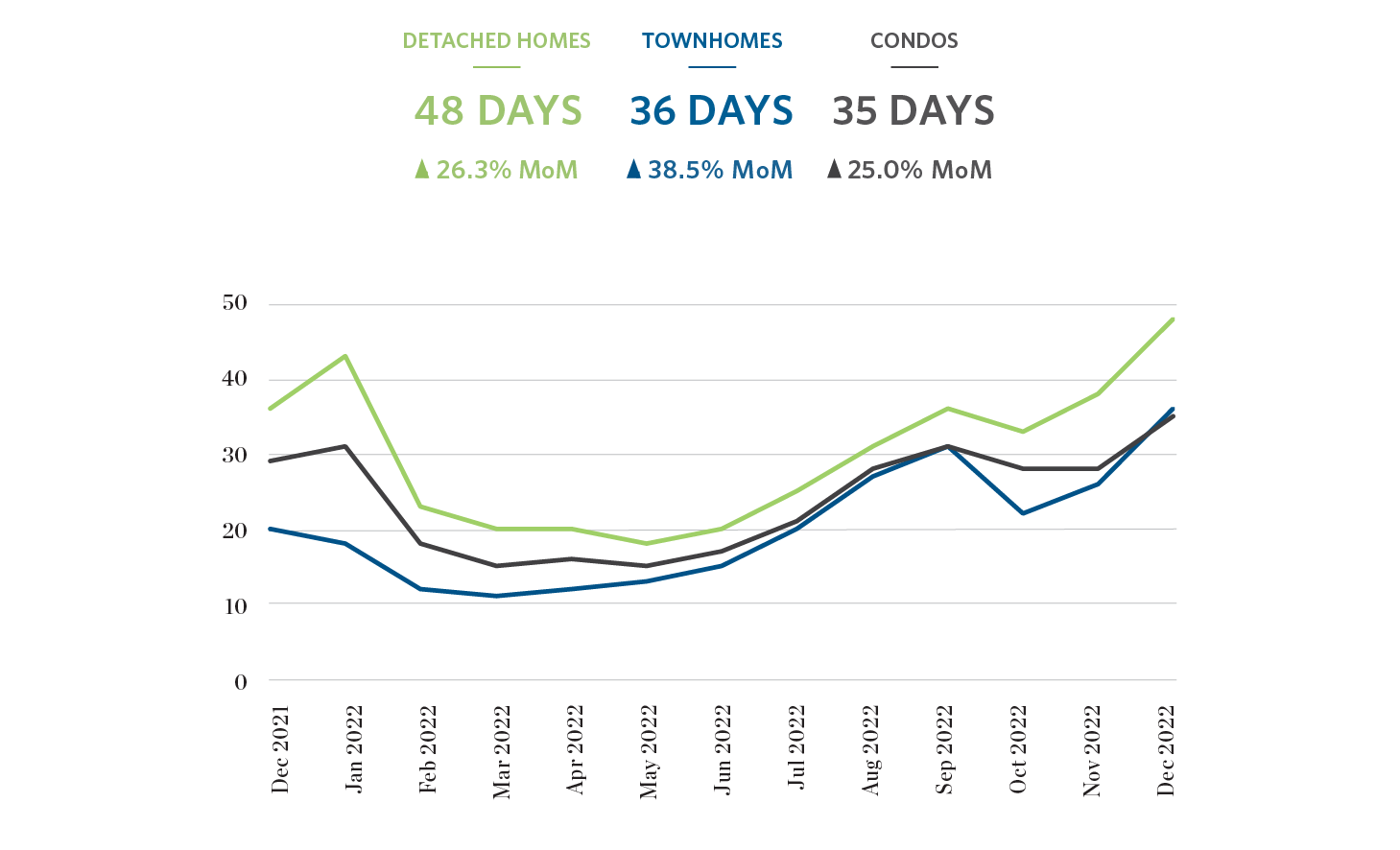

Days on Market

Homes stayed on the market for a significantly longer time in December compared to the previous month. Detached homes took 26.3% longer to sell in December compared to November, while townhouses took 38.5% longer and condos took 25% longer.

THE REAL ESTATE BOARD OF GREATER VANCOUVER DECEMBER 2022 STATISTICS IN INFOGRAPHICS

Sales To Active Listings Ratio

The blended sales to active ratio for all product types remained relatively unchanged at a balanced market level in December 2022. Detached homes had the biggest change, shifting closer to a buyer’s market, while condos shifted back towards a seller’s market during this period.

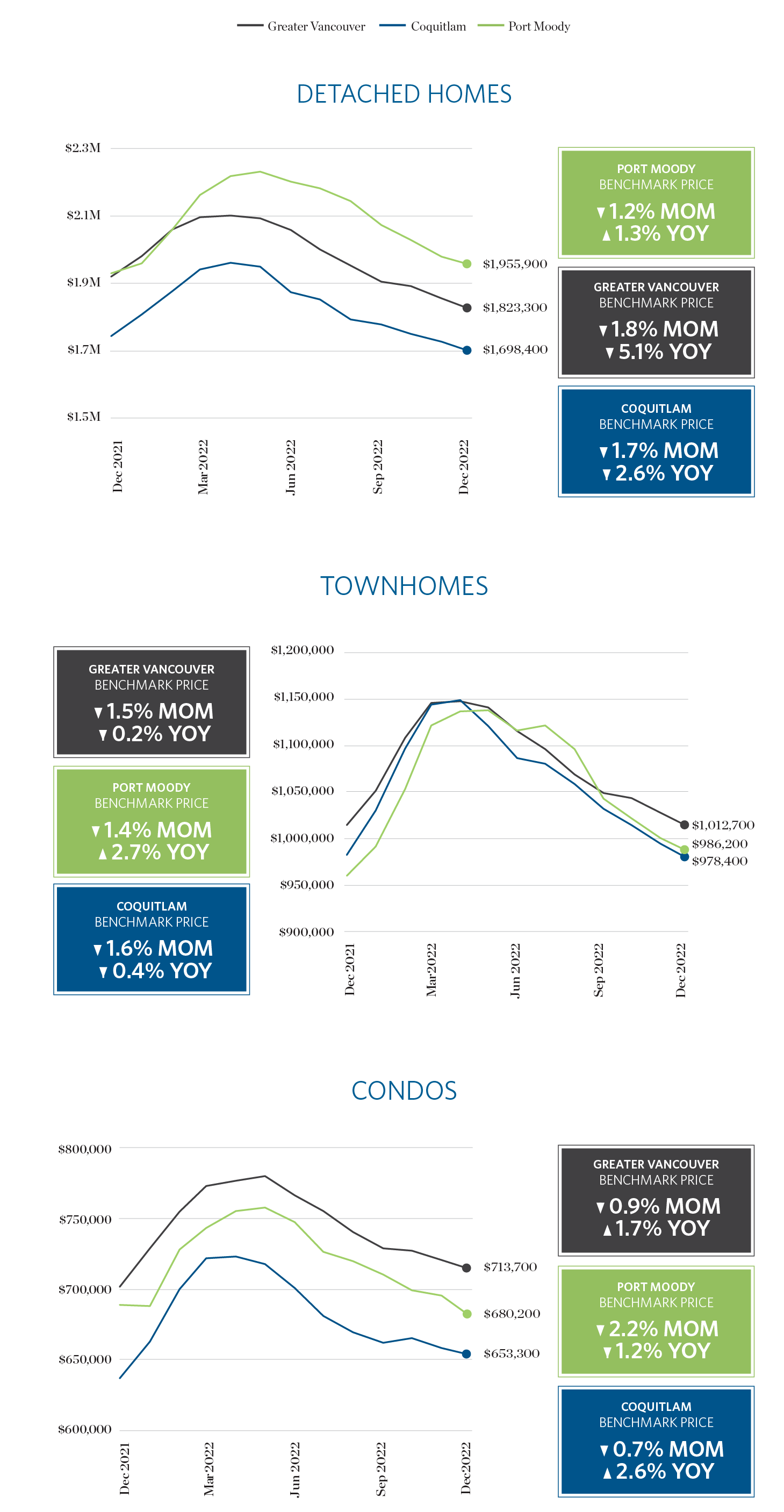

HPI Benchmark Prices

The Home Price Index (HPI) measures the price of a benchmark, or typical, property in a given market and is not influenced by the change in composition of properties sold, which can fluctuate quite significantly from month to month. As a result, this metric is a more pure and stable representation of market price change than average or median prices.

Yet again, benchmark pricing saw a month-over-month decrease across all product types. Prices for condos remained above those reported in December of last year, however, detached homes and townhouses dipped below last year’s figure by 0.2% and 5.1%. We anticipate the downward pressure on pricing will continue into 2023 as BOC tries to maintain economic stability.

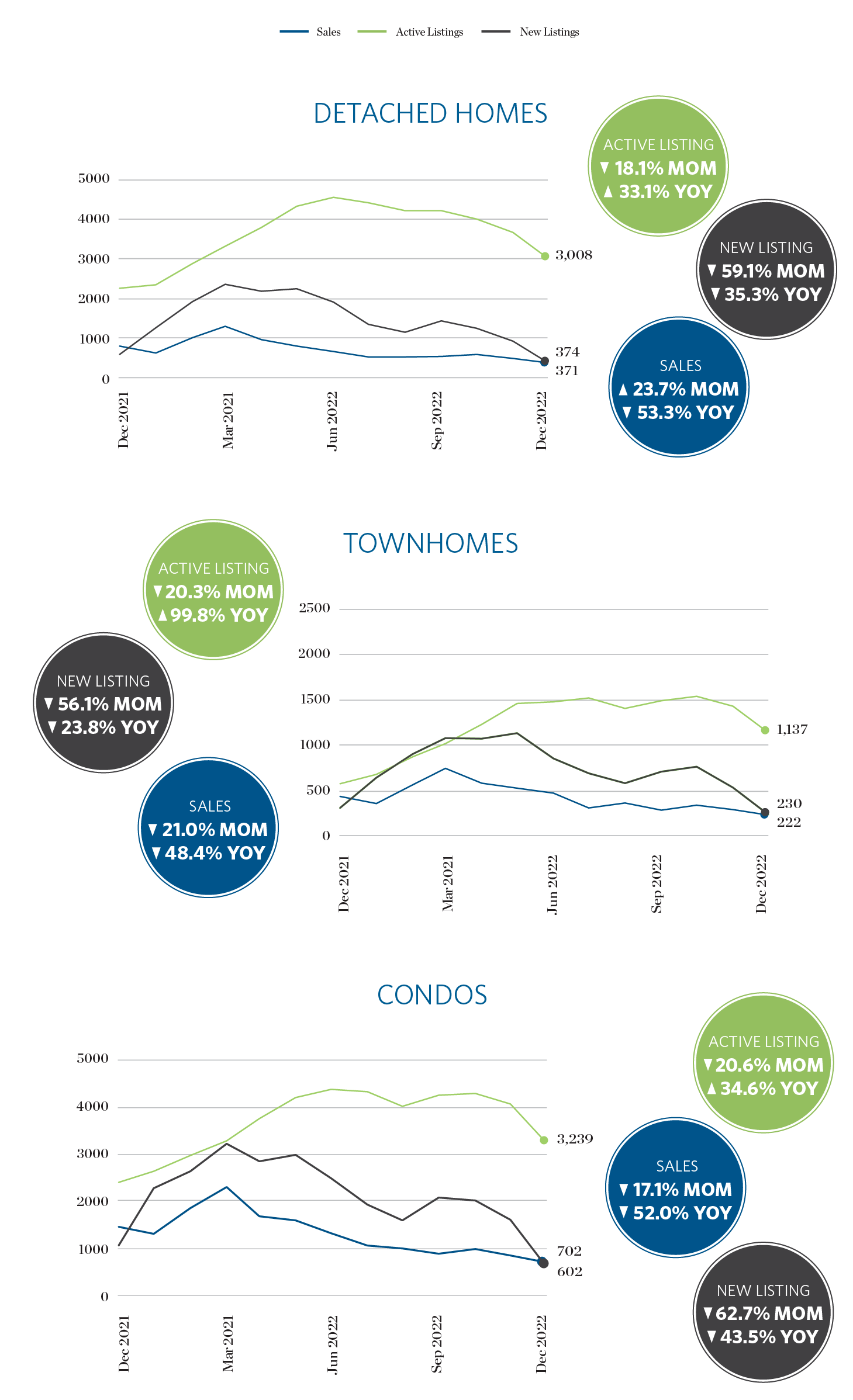

Sales • New Listings • Active Listings

December saw a significant drop in new listings for all product types, with an average of 59% percent drop from last month, this resulted in a significant month-over-month decrease in active listings, though inventory did end the year above 2021 levels. Sales also declined across all product types at an average of 20.6%.

Further Reading

View the Real Estate Board of Greater Vancouver’s entire stats package for December 2022 here.

Sources

This representation is based in whole or in part on data generated by the Real Estate Board of Greater Vancouver which assumes no responsibility for its accuracy.

Please note: areas covered by the Real Estate Board of Greater Vancouver include: Whistler, Sunshine Coast, Squamish, West Vancouver, North Vancouver, Vancouver, Burnaby, New Westminster, Richmond, Port Moody, Port Coquitlam, Coquitlam, Pitt Meadows, Maple Ridge, and South Delta.