Fraser Valley Residential Real Estate: June 2018 Infographic

The Fraser Valley Real Estate Board’s stats are out for June and it’s a similar picture as last month as price growth decelerates, sales decrease and the market balances. With government intervention throwing a wrench into the gears of our typical seasonal trends, looking at longer-term historical metrics adds much needed context to the dramatic shifts we’re seeing in key metrics.

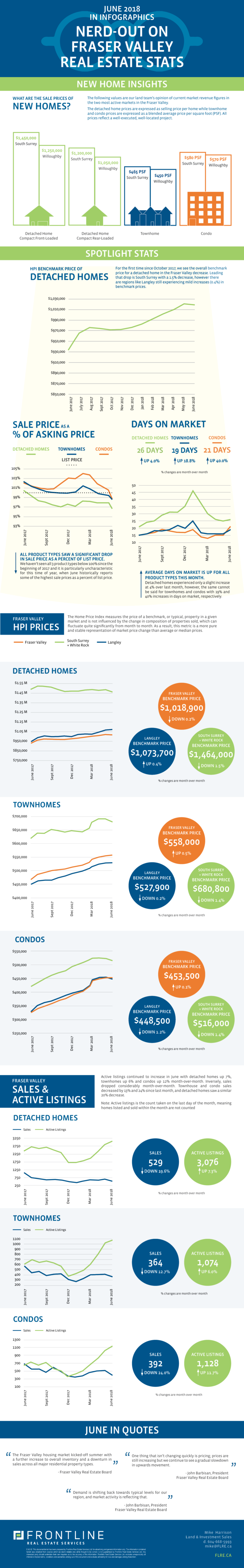

There were 7,141 active listings at the end of June this year, a 30% increase over June 2017. Inventory may appear to be increasing dramatically but this month’s inventory is still only 92% of the 10 year average for the month of June.

The month’s total sales are reported as a 43.5% decrease over June 2017 but like active listings, looking back further than 1 year reveals that sales are returning to more typical, historical levels. For example, this month’s 1,452 total sales are comparable with June sales in 2011, 2012, 2013 and 2014.

Despite a decrease in sales this month, benchmark prices of attached homes are holding, with the price of a townhome up 0.5% month-over-month and the price of a condo up 0.1%. Fraser Valley detached homes also stayed relatively steady, experiencing a mild decrease in benchmark price (-0.2% month-over-month) following 7 months of increases. Interestingly, the Langley and Maple Ridge detached home markets experienced small price increases (less than 1%) while a 1.5% month-over-month decrease in South Surrey/White Rock pulls the Fraser Valley average down.

Demand continues to moderate as average days on market increases and sale price as a percent of list price dropped below 100% for all product types for the first time since winter 2017. That being said, the attached market remains a seller’s market for now. The detached single family market, on the other hand, has entered balanced market conditions with a sales to active listings ratio of 16% (balanced market conditions are considered to be between 12% and 20%).

What does this mean for development land in the Fraser Valley? Steady end product pricing is making land values sticky; however, developers are forecasting absorption rates more typical of a few years ago and exercising increased amounts of discipline in their land purchase decisions.

Check out our curated summary of the Fraser Valley Real Estate Board’s June stats in infographics below.

View the Fraser Valley Real Estate Board’s entire stats package for June 2018 here.

This representation is based in whole or in part on data generated by the Fraser Valley Real Estate Board which assumes no responsibility for its accuracy.