Fraser Valley Residential Real Estate: June 2021 Infographic

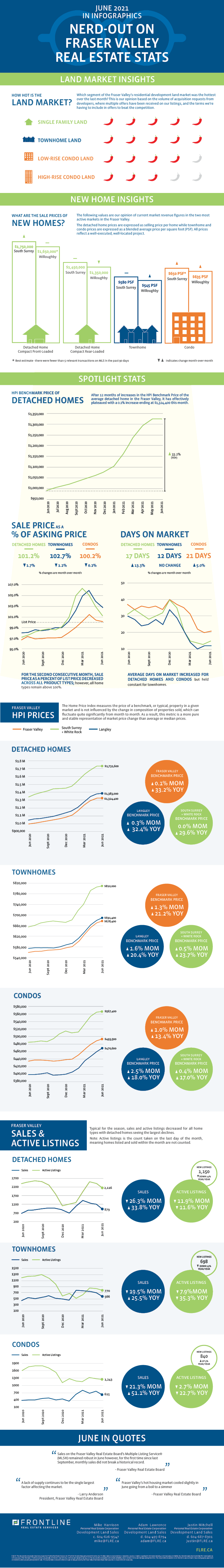

The Fraser Valley real estate market continued to mellow out in June with the Board’s statistics showing decreased sales, moderate increases in days on market and selling prices falling back down near original list prices.

Total sales pulled back moderately in June and for the first time since last September, did not set a new all-time record. That being said, June was no slouch, ending the month with total sales 23% above the 10-year average.

Active listings were down 3-12% from May and 12-35% from this time last year, depending on home type. Furthermore, total active listings for June were only 69% of the 10-year average. This is a challenging, if not misleading, metric as it’s the count of active listings on the last day of the month and there are many listings that simply won’t get counted when the average days on market is so far below 30. It’s how we can have total active listings at 69% of the 10-year average but total sales sitting at 23% above the 10 year average at the same time.

HPI Benchmark prices continue to decelerate with the single family segment effectively plateauing. Condo and townhome prices still rose over last month by 1.0% and 1.3% respectively but this is a stark contrast to the 3.0 to 4.5% increases we saw each month in the first half of this year.

A decline in sale price as a percent of list price and increase in the average days on market are also indicating deceleration but context is important here. All major home types still show an average sale price above the original list price and days on market, as an average across all home types, is still lower than ever, even beating out the peak of 2016.

What does this mean for the development land market in the Fraser Valley?

The persistent strength in the home market has demand for development land holding steady at peak levels. However, the mild deceleration in the home market has taken the frenzy out of the land market and allowed deal terms to relax.

For the most part, land values are holding flat, influenced by the flattening of end product revenues and increased construction costs. Sure, lumber prices have withdrawn but that’s just one of many inputs that have increased recently and it will be some time before it is realized in the market.

We’re heading into what is typically a seasonal lull and, while it was largely non-existent last summer due to the inability to travel for summer vacation, we anticipate a quieter summer this year as people take advantage of relaxed travel restrictions. This could make for an opportune time to acquire your next site while others are out of town. Don’t get me wrong, you won’t get a discount, but you just might actually be able to secure a site.

Check out our curated summary of the Fraser Valley Real Estate Board’s June stats in infographics below.

View the Fraser Valley Real Estate Board’s entire stats package for June 2021 here.

This representation is based in whole or in part on data generated by the Fraser Valley Real Estate Board which assumes no responsibility for its accuracy.