North of the Fraser Residential Real Estate: April 2019 Infographic

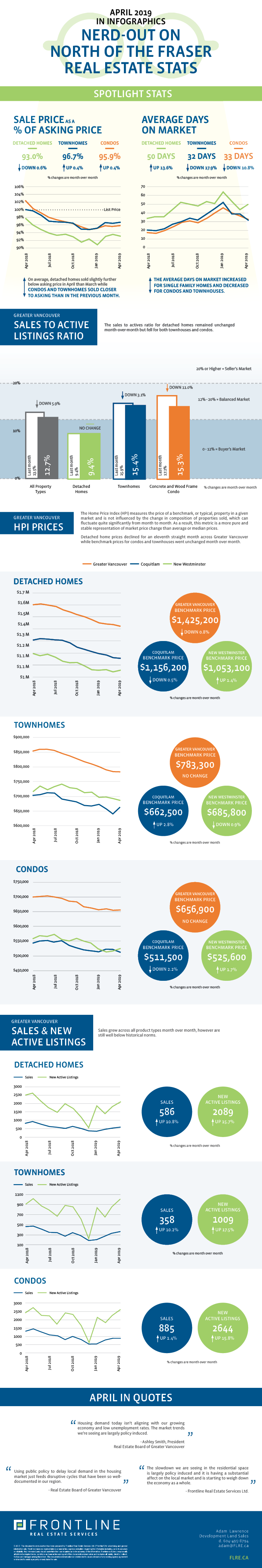

The April stats are in from the Real Estate Board of Greater Vancouver and they depict a similar story of the market as has been seen for several months: historically slow sales, a flattening or decline in HPI prices and an overall increase in active listings.

Despite total sales posting a modest 5.9% increase over the March figures, they were still 43.1% below the 10- year April sales average. In total 1829 homes traded during the month of April, of which 586 were detached, 885 were condos and 358 were townhouses.

Prices for detached homes fell an additional 0.8% month-over-month and have now come down by 11.1% across Greater Vancouver since April of 2018. In Coquitlam, detached prices were down 0.5% month-over-month landing them 11.4% below last year. New Westminster saw benchmark prices increase by 1.4% over last month but were still 11.7% below April 2018.

Condo and townhouse benchmark prices were flat across Greater Vancouver month-over-month. Coquitlam condos experienced a 2.2% decrease while townhouses bucked the trend with a 3.8% increase. The condo market in New West saw a 1.7% price increase while townhouse prices declined 0.9% over March.

There were 5,742 new MLS listings across Greater Vancouver in April, which was a 1.3% decrease from the number of homes newly listed in the same month last year. Total active listings are now at 14,357 which is 46.2% higher than this time last year.

Given the jump in new listings and the recent slowdown in sales, it’s not surprising that the Board is reporting that there are now more properties for sale on the MLS than at any point since October 2014. Despite this upward trend in total listings, the count is only 1.9% above the 10 year average for the month of April (an average that includes data points for 2016-2018 when supply was severely constricted) and is well below the peak for the month of April of 17,650 active listings witnessed in 2013.

What does this mean for development land north of the Fraser?

Sales are slow and prices for all product types have retreated from the record highs observed over the last several years, but the sky isn’t falling. We are now seeing the consequences of unprecedented government intervention in the Vancouver housing market, some of which were intended and some of which were not. While prices have certainly come down, the affordability of housing for would be home buyers in Vancouver has actually gotten worse, especially first time buyers handcuffed by new mortgage lending rules.

The stats may show that the supply of available homes on the MLS has returned to historical levels but the number of new listings hitting the market every month is not outside of historical norms. A return to historical levels of demand will likely result for a shortfall in available product down the line.

Our developer clients are still actively making purchases and well located, well priced multi-family sites are still in demand. However, the supply of these types of sites has increased across the market, reducing vendor’s negotiating power. Our advice to owners of these sites is that now is not the time to sell if you simply want to sell as you will be competing with vendors who need to sell. Prudent, well capitalized purchasers of development sites are acutely aware of the difference between these two types of vendors and, as such, are taking their time to ensure that potential acquisitions fit into their business model- as well as their pro forma- before making acquisitions.

Check out our curated summary of the Real Estate Board of Greater Vancouver’s April stats in infographics below.

Please note: areas covered by the Real Estate Board of Greater Vancouver include: Whistler, Sunshine Coast, Squamish, West Vancouver, North Vancouver, Vancouver, Burnaby, New Westminster, Richmond, Port Moody, Port Coquitlam, Coquitlam, Pitt Meadows, Maple Ridge, and South Delta.

View the Real Estate Board of Greater Vancouver’s entire stats package for April 2019 here.

This representation is based in whole or in part on data generated by the Real Estate Board of Greater Vancouver which assumes no responsibility for its accuracy.