Willoughby State of the Market Report 2023

Below is our 2023 State of the Market Report on residential development in Willoughby, with a focus on the emerging neighbourhoods as well as in-process development applications and development land sale trends.

STATE OF THE MARKET IN WILLOUGHBY

Following an impressive two-year high amidst the pandemic, the housing market is now experiencing a sobering yet moderate correction. With seven interest rate hikes in 2022 and another three in 2023, pushing the rate up to 5%, navigating the development land market has become increasingly challenging. Despite elevated borrowing costs, conversations with local developers reveal that the Willoughby area remains highly desirable. The Willoughby neighborhood’s strategic location, offering easy access to Highway 1, the best schools, and a rapidly expanding array of amenities, lends it an inherent value that ensures a strong and resilient residential market.

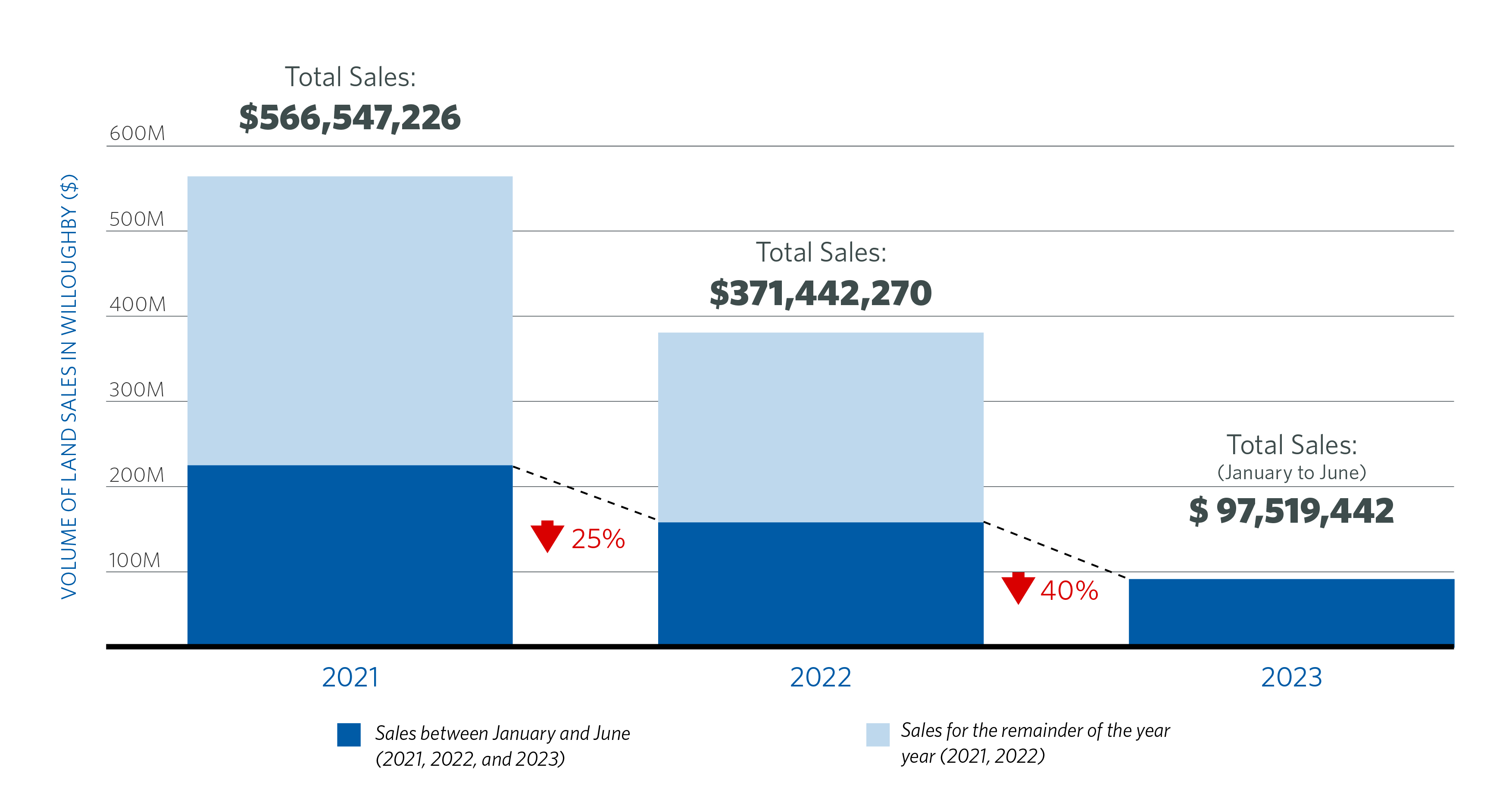

Looking at the transaction data for residential development land in Willoughby, land deals are experiencing a decline. In comparison to the same time period in 2021 and 2022, the number of transactions in 2023 has significantly decreased. This decrease in transactions, total land sale value, and acreage sold is attributed to higher interest rates and rising municipal costs, making participants in the Willoughby market more cautious in buying and selling.

DEVELOPMENT APPLICATIONS IN WILLOUGHBY

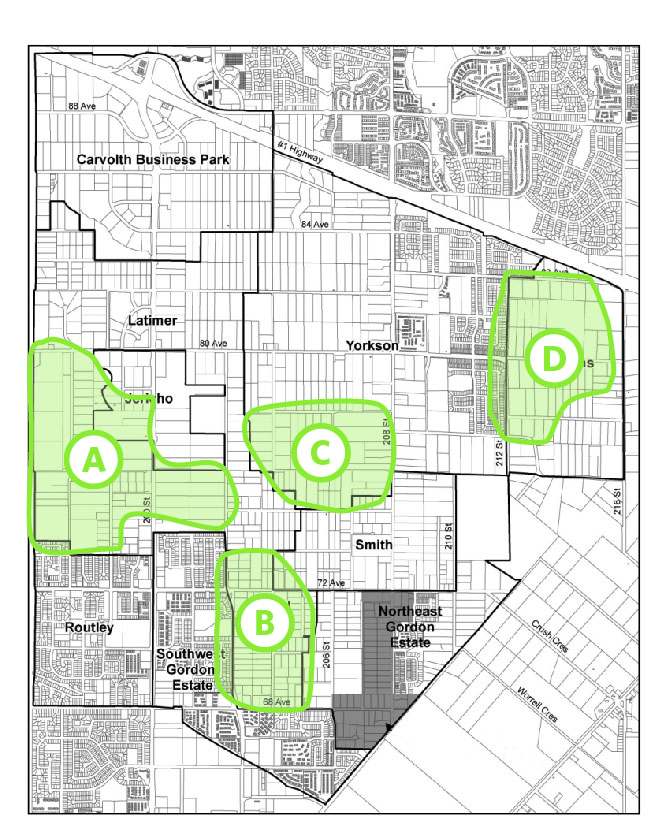

In Willoughby, there are four major areas that encompass most of the active development applications. These areas collectively propose over 6,500 new homes, spanning across 530 acres. The four key areas highlighted below indicate where the bulk of new construction will take place in the coming years. While the summary statistics below might suggest an exceptionally high volume of new inventory for the market, it is important to note that these applications are at various stages in the planning process and will not be introduced to the market simultaneously. Although a handful of these applications may come to fruition this year, many will require two years or more to be fully realized.

A) Southwest Latimer

31 significant* applications for residential development.

2,985 units proposed over 115+ acres

758 Townhouses

2,032 Condos

195 Single Family Homes

B) Central Gordon

31 significant* applications

for residential development.

1,803 units proposed over 79+ acres

1,365 Townhouses

209 Condos

229 Single Family Homes

C) Southwest Yorkson

21 significant* applications

for residential development.

1180 units proposed over 93+ acres

578 Townhouses

490 Condos

112 Single Family Homes

D) Williams

9 significant* applications

for residential development.

644 units proposed over 191 acres

132 Townhouses

512 Condos

0 Single Family Homes

* A “significant” application is any application with greater than 5 units or lots

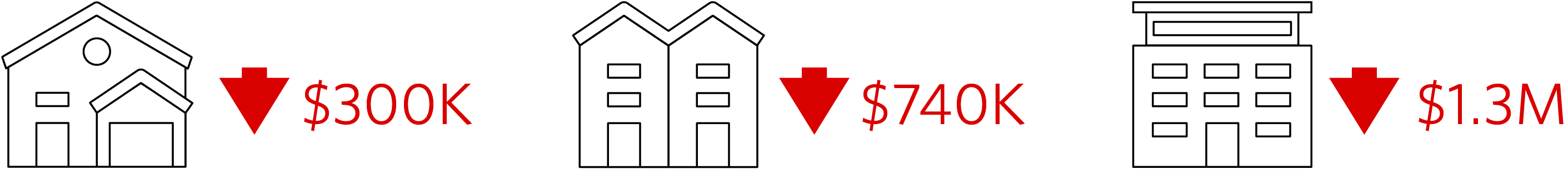

Municipal Cost Increase

In addition to rising interest rates, two updated development costs are impacting land value. The Community Amenity Contribution (CAC) policy has increased by 153% on average across all housing types, such as single family homes, condos, and townhouses. The Development Cost Charge (DCC) has also surged, with a 60% average increase. These increases in costs directly offset the development value of the land, resulting in a reduction in price per acre. See below for approximate reduction across various land types in price per acre.

What’s to come

In the past few months of 2023, the market has begun to exhibit subtle signs of recovery. Developers have been willing to pay premium prices for sites in prime locations, indicating that location has been a crucial factor during this market downturn. The benchmark price for various types of properties, including townhouses, condos, and detached homes, has seen a slight increase on a month-over-month basis. For a more comprehensive analysis of the housing market, please visit our website to view our latest statistics here.

NEIGHBOURHOOD UPDATES

Below you will find a summary of the distinguishing features of each neighbourhood as laid out in the draft plan, as well as an update on the current status of each neighbourhood.

Latimer

- Construction at Vesta’s Latimer Heights master planned community has made significant strides, with the phases nearing completion. They are now in the final phase of homes, with 50% of the units already sold. The southwest quadrant along 200th Street saw multiple construction starts and projects selling out in 2022. This area continues to be a hub of activity, underpinning subsequent developments in the region and bringing much-needed residential options to the market.

Central Gordon

- The completion of the long-awaited stormwater detention pond on 202B Street has finally unlocked development in the western area after years of delays. With construction now in full swing in the northwest part of the neighborhood along 202B Street, the area is witnessing rapid growth. Notably, five new projects have been launched since 2022, with two of them already selling out, adding to the area’s momentum and promise for the future.

Yorkson

- Most of development activity was focused on the ongoing construction of condo and townhome projects near Willoughby Town Centre. A significant mixed residential development was also underway in the southwest quadrant. Given that much of Yorkson is already developed, land transactions primarily involved the assembly of multiple properties for a 69-lot single-family development, which was confined to the undeveloped southwest quadrant.

Williams

- Preliminary endorsement has been granted by the Mayor and Council of the Township of Langley for the revised Williams Neighbourhood Plan. The sweeping changes include a significant increase in residential densities as high as 6 storeys adjacent to 80 Avenue, a transformation of retail areas into a Business Park, and updated community amenity fees. Despite 60% of the neighborhood having development applications, there is still no physical change evident in the area. This blueprint marks a pivotal step toward a vibrant, integrated community, with public consultations to follow, aiming to translate these plans into tangible improvements.

Carvolth

- Cranes and trucks are the daily norms in this neighbourhood as construction activities continue steadily. The Township of Langley (TOL) anticipates the neighbourhood to be a centre of growth as most of the neighbourhood is under application or already built-out.

Smith

- Development status of Smith remains unchanged from our last report. The neighborhood continues to face a stall in progress, eagerly awaiting the acquisition of the essential elementary school and park site. This delay has persisted, limiting any significant advancements in Smith during

this period.

North East Gordon

- North East Gordon remains largely consistent with the previous year. Progress continues on the west side with single-family developments, while the area between 207 Street and 208 Street is still awaiting the construction of the necessary stormwater detention pond. This uncertainty around the development timeline continues to suppress land values. Despite these challenges, the area holds potential for future growth and development.

Jericho

- The circumstances in Jericho continue to mirror those of the previous year. The high-rise project remained stagnant, and while there were a few land transactions, no significant construction activity was observed.

Southwest Gordon & Routley

- These neighbourhoods are substantially built out with minimal new development.

SOURCES

In creating this report, we survey multiple land transaction reporting systems (Commercial Edge, MLS), analyze municipal development data, and consult the Township of Langley planning staff as well as key stakeholders to bring you the most relevant information. If you have any questions about this report or the local development land market, don’t hesitate to reach out.

To receive future reports directly to your inbox, please sign up for our development land newsletter here.