Fraser Valley Residential Real Estate: November 2020 Infographic

The Fraser Valley Real Estate Board’s statistics are out for November and the market is unrelenting, setting more record sales figures while prices continue to climb.

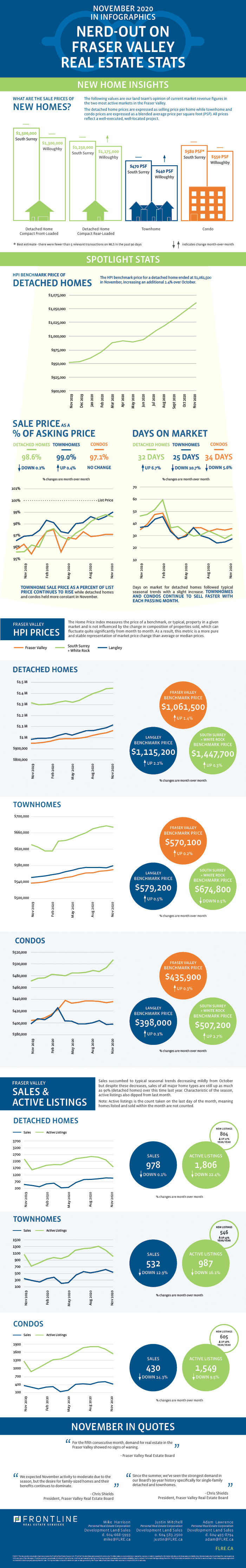

As we near the end of the Fall market we would expect to see a dip in all key metrics—sales typically decline, days on market increase and active listings build up. If you look really close you can see hints of a seasonal lull but it’s much subtler than years past.

Technically, sales declined for all home types compared to last month but detached home sales only declined 0.1% and are still up 90% over this time last year. This is significant considering November typically sees double-digit month-over-month declines in sales. Despite the decreases, total sales for all home types ended the month at 165% of the 10 year average setting a record for the 5th month in a row.

As expected for this time of year, active listings declined 10-22% depending on home type and, for the first time all year, climbed above the month’s 10 year average.

Despite the whispers of a winter slow down, average days on market still declined for townhomes and condos. Similarly, sale price as a percent of list price increased for those two home types. What’s interesting is that, for detached homes, average days on market increased and sale price as a percent of list price declined. The single family market tends to be the leading indicator in the Valley, so we may see the attached market follow suit shortly.

The HPI benchmark price of all home types climbed again from last month. Townhomes and condos rose 0.2% and 0.3% respectively, and detached homes jumped another 1.4%. The HPI Benchmark price of a detached home in Langley is up 2.2%!

What does this mean for development land in the Fraser Valley?

Extraordinarily strong sales and rising prices have builders and developers scrambling to secure their next site. The available properties that were hanging out pre and mid-pandemic are now being snatched up, resulting in a further shrinking supply of development sites throughout the Fraser Valley. Not surprisingly, land values are climbing as a result of increased buyer competition and end product price escalation, which is allowing developers to justify higher purchase prices for land.

With the hot land market, we have seen the re-emergence of less disciplined buyer behaviour as some look to tie up sites merely to flip them and others submit offers at a price high enough to beat out any competition, knowing a price reduction will be sought prior to subject removal. As a seller it is, once again, critical to understand both the identity and the intentions of your potential purchaser to achieve a successful outcome.

Check out our curated summary of the Fraser Valley Real Estate Board’s November stats in infographics below.

View the Fraser Valley Real Estate Board’s entire stats package for November 2020 here.

This representation is based in whole or in part on data generated by the Fraser Valley Real Estate Board which assumes no responsibility for its accuracy.