North of the Fraser Residential Real Estate: March 2019 Infographic

The March stats are in from the Real Estate Board of Greater Vancouver and they show the arrival of the Spring Market in earnest.

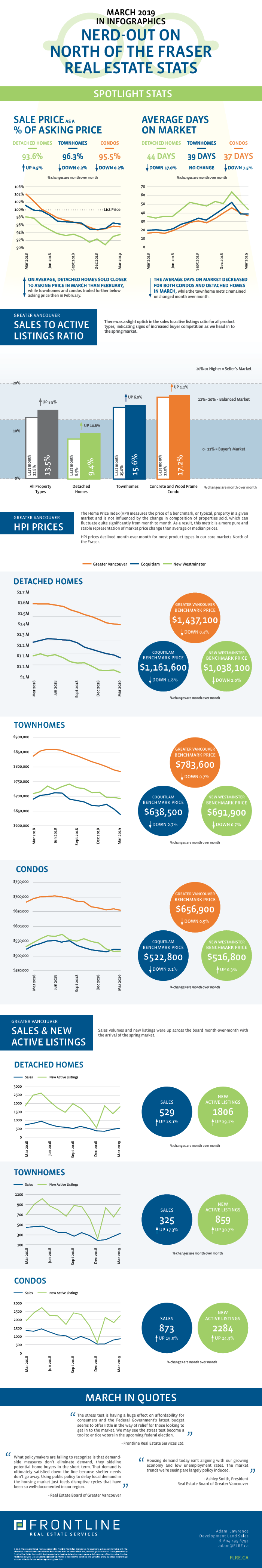

While last month was the slowest March for sales since 1986, sales were up across all product types month-over-month, led in part by a strong showing from the detached sector, which experienced an approximate 18.1% increase while townhouse and condo sales increased 17.3% and 15.0% respectively.

The increase in sales for detached homes is encouraging as it suggests that some buyers are starting to recognize value in this segment of the market after a long period of price declines, also that these buyers are able to get the financing they need to complete on the purchase of a detached home. No small feat considering the numerous challenges imposed on prospective buyers by the mortgage stress test.

Prices declined across all product types in our core markets of Coquitlam and New Westminster, except for a slight increase in the benchmark price for condos in New Westminster. Despite these decreases, there were some signs of life in several submarkets that have been disproportionately affected by the barrage of new taxes and regulations introduced to the market in the last 24 months. Notably, single family prices increased or remained flat in 8 submarkets monitored by the Real Estate Board of Greater Vancouver (Burnaby North, Burnaby South, Ladner, Maple Ridge, North Vancouver, Pitt Meadows, Richmond and the Sunshine Coast). This further suggests that competition for single family properties is increasing and that buyers are getting more comfortable with taking on the risk of a purchase in this market.

What does this mean for development land in Greater Vancouver? In large part, the prolonged slow down we are seeing in the Greater Vancouver housing market is a product of government policy as opposed to a shift in market fundamentals. The mortgage stress test, in particular, is hampering affordability for local buyers and in the face of falling mortgage rates one must wonder how long the stress test in its current form will remain viable. Right now, there is an affordability cap on properties around the $1,000,000 mark, so projects reflecting value relative to that cap should enjoy successful sales campaigns this spring. This affordability cap is a challenge for most single family developments North of the Fraser, as development land prices are unlikely to capitulate to the point where developers can sell new detached homes for under $1,000,000.

However, well-executed townhouse and condo projects in our core markets should still see strong absorption with average quantum dollar prices hovering around the $1,000,000 mark. Recently, we’ve observed strong sales for townhouse projects located on Burke Mountain that indicate that this strategy works. With several launches planned for April and May, it will be interesting to see how this strategy plays out in more urban, transit-oriented markets like Burquitlam and on the mainland in New Westminster.

Check out our curated summary of the Real Estate Board of Greater Vancouver’s March stats in infographics below.

Please note: areas covered by the Real Estate Board of Greater Vancouver include: Whistler, Sunshine Coast, Squamish, West Vancouver, North Vancouver, Vancouver, Burnaby, New Westminster, Richmond, Port Moody, Port Coquitlam, Coquitlam, Pitt Meadows, Maple Ridge, and South Delta.

View the Real Estate Board of Greater Vancouver’s entire stats package for March 2019 here.

This representation is based in whole or in part on data generated by the Real Estate Board of Greater Vancouver which assumes no responsibility for its accuracy.