How To Calculate Development Land Value

In this article, we examine the two most common methods for valuing residential development land: comparable analysis and residual land value analysis.

How much is my property worth to a developer?

A developer will value your property based on what can be built on your property in the future. This means your property value will depend on a variety of characteristics including:

- Size

- Land use designation or zoning

- Development hurdles (waterways, topography, etc.)

- Home/end product sales (learn more about this here)

The more dynamic the residential real estate market is, the more challenging it becomes to accurately value properties, especially those with development potential. For this reason, we wanted to share an overview of the two most commonly used valuation methods, which are explained below.

If you want to know how much your unique property is worth to a developer, submit the below form to request a free, no commitment, valuation of your property. Looking to calculate commercial property value? Click here.

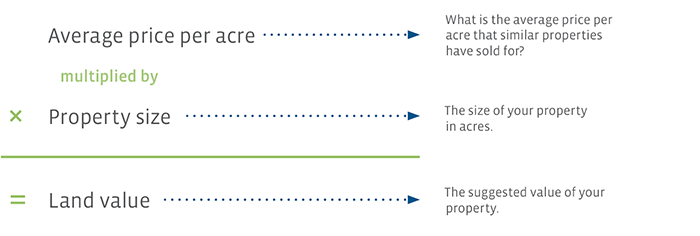

COMPARABLE ANALYSIS

The most common valuation method, used in the residential resale market, uses recent comparable sale transactions as a basis for value. Recent sales of similar properties are analyzed to find an average sale price per acre (or per square foot) and this is applied to the size of the subject property. This method looks like this:

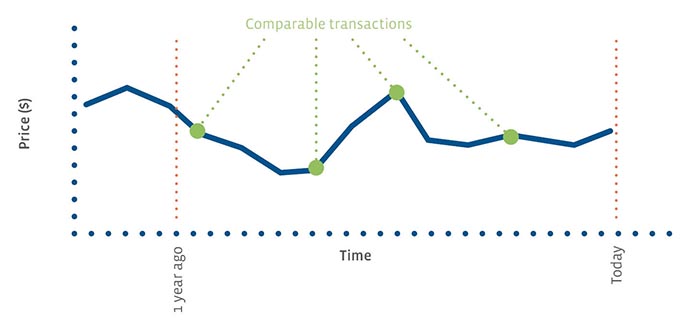

In dynamic real estate markets like the Fraser Valley and Metro Vancouver there are 3 big challenges with using this method to calculate a development property’s value:

- Not all development land properties are the same. Property features like creeks, future roads, setbacks, and slopes are commonly overlooked when reviewing comparable sales. These factors significantly impact a property’s development potential.

- Development land transactions can have long timelines. Many development land transactions take 6-18 months to complete and since the sale price is negotiated at the beginning of that time, sale prices can be 6-18 months old by the time the transaction details become public.

- Land values are changing constantly so the “comparable” average price per acre derived from other transactions may not be accounting for a recent sudden shift in the market.

These challenges can lead to determining a value for the property that is incorrect. Because of this, it is critical to use the developer’s valuation method, whenever possible, to find what is known as the residual land value.

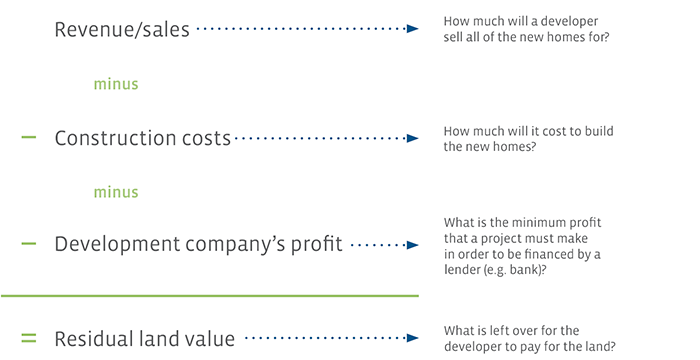

RESIDUAL LAND VALUE ANALYSIS

The more complex method of calculating land value, used by developers, involves running a development proforma. A development proforma is a financial projection of the project that could be built on a property. It is a reverse calculation that concludes with the price that can be paid for the land after all costs have been subtracted from the total selling price of all future homes. This calculation determines the point at which the future project is financially viable. Simplified, the development proforma looks like this:

This method is more accurate than a comparable analysis because it uses current selling prices for the new homes to be built and current construction costs, rather than a potentially dated price per acre derived from other land transactions. Thus, the residual land value method represents the price a developer can afford to pay today, rather than what a developer paid in the past for similar properties.

Follow the links below for neighbourhood specific case studies showcasing how using the residual land value method assured a property was priced appropriately and helped maximize the ultimate sale price:

If you would like more information regarding land values in the Fraser Valley or Metro Vancouver, please don’t hesitate to reach out or click here to subscribe and receive information like this, plus development land listings and transactions, right to your inbox.

If you want to know how much your unique property is worth to a developer, submit the below form to request a free, no commitment, valuation of your property.